Gone are the days when PE investors (both domestic and global) have been crazy to leverage the long-term consumption story of India. However, in a scenario like a Pandemic, PE investors become highly conscious to park their capital with portfolio companies in India and globally.

How Private Equity Funding Works

Since business needs to have funding requirements be it for working capital or CAPEX for a long-term period. Needless to say that the funds available through banks with low cost of capital compared to private equity. When we analyze the financial position of a company, we can say that significant debt is necessary to optimize the capital structure. Then why do we want to get a private equity fund? There are various benefits to applying for a Private Equity fund though the cost of equity is high in this case. Because PE investors invest in a company for almost 5-7 years horizon, and during this timeframe, they add value to the business, streamline governing system thereby increasing value to shareholders. They may take exit through a variety of options namely, IPO, Mergers & Acquisition, Buyback to Promoters, etc. Additionally, PE investor acquires from minority stake to majority stake to completely buy out the transaction. The PE investor always would like to capital gain at the maximum with the highest IRR in all transactions.

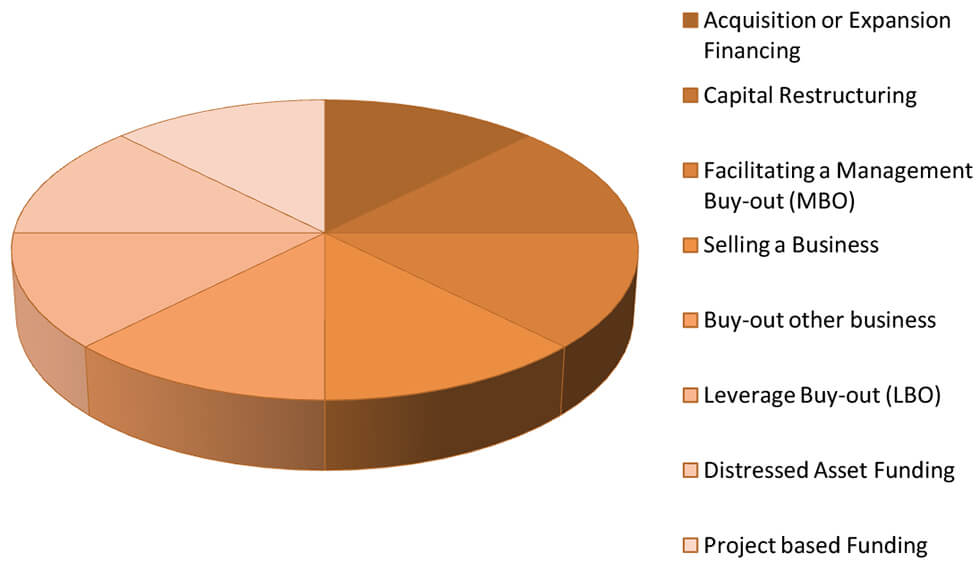

Key Rationales to apply for Private Equity Fund

There are key rationales to get PE fund which can be analyzed from the analytics below:

The key players involved that help companies raise capital through private equity placement are investment bankers, financial consultants, financial professionals, etc.

Utilization of Private Equity Fund

There are a variety of benefits that a company can reap while using a private equity fund. The following analytics can explain the benefits more precisely:

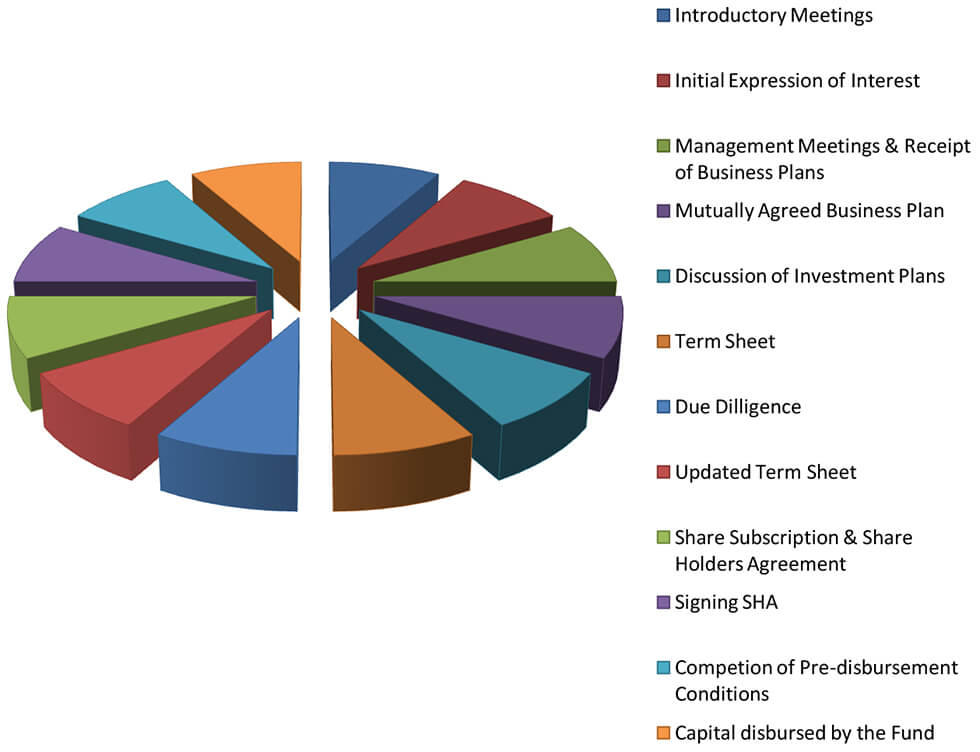

Fund Disbursement Process

The Private Equity fund disbursement process takes almost 15 to 18 weeks process which can be seen from the following analytics:

From the aforesaid analytics, it is clearly stated that the entire cycle starts from Day Zero followed by reaching certain milestones until the deal closure.

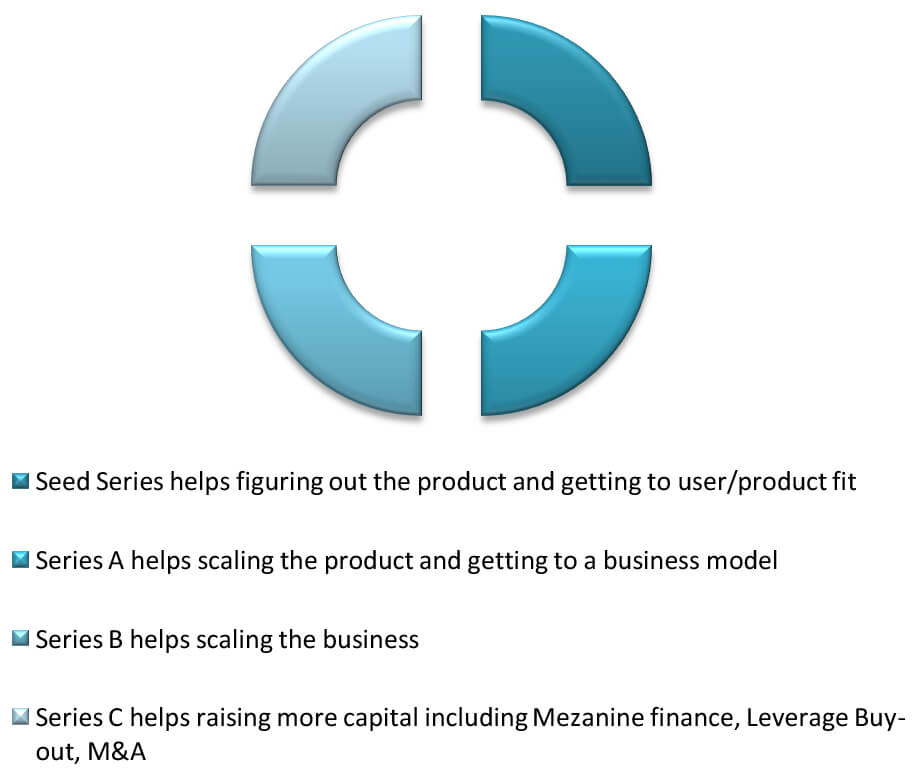

How Funding Options Differ

The fundraising exercise starts with identifying the cycles of a business where it needs to fuel growth by acquiring various capital like Seed fund, Series A, Series B, and Series C among other series available.

The following analytics helps identify various series of capital raised for various purpose:

With the strategic engagement in place, the P E investor adds value by some or other alternative options available.

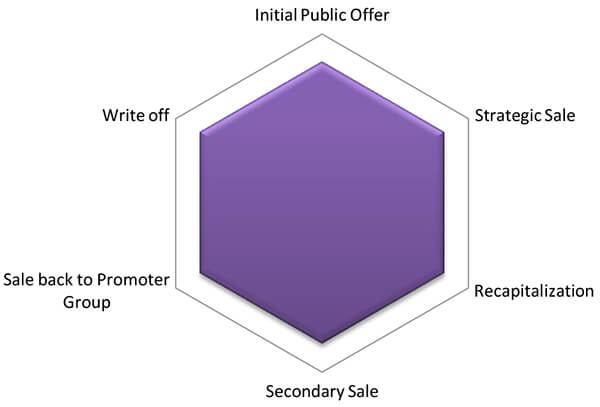

Exit Strategies

It usually takes five to seven years of engagement with a portfolio company, and once the engagement is over, the PE investor explores various Exit options which can be understood from the following analytics:

From the aforesaid analytics, we can easily postulate how a PE investor exits its investment from the portfolio companies. The Strategic sale is selling a stake to a competitor or strategic buyer. Whereas in the IPO exercise, the portfolio company go public. Recapitalization is not exactly an exit option, however, the company issues debt to fund dividend distribution to the fund. Of course, this is the way towards going to exit. The Secondary sale takes place when the fund sells its stake to other private equity investors or financial investors. The Write-off or liquidation takes place especially when the portfolio company has incurred certain losses, so those have to be adjusted. If the PE investor does not find either of these options, he may sell the stake back to the promoter to recover the targeted return.

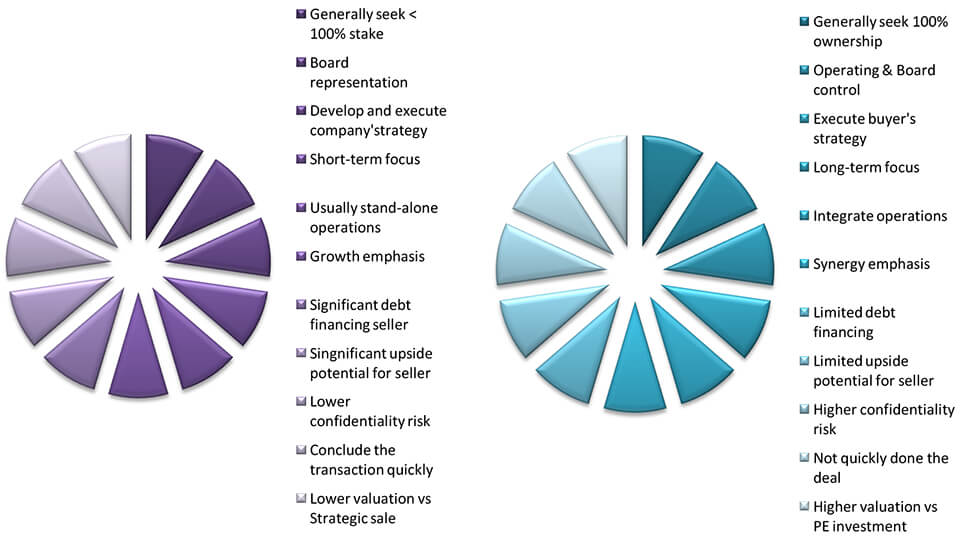

How Private Equity Investment differs from Strategic Investment

There are numerous differences between the two transactions of strategic investment and private equity transactions as stated below:

In a nutshell, if you have acquired to scale up your business with a strong vision in place, you should have a team of professionals who can execute the fundraising exercise through their best financial modelling expertise (an area of FP&A domain) to identify a prospective investor and then representing the company to initiate the entire PE process. Let us not forget that there has been a transaction where the PE investors have been crazy to go for the first, second, and third round of investment in the same portfolio company. Thanks to the business models that the portfolio companies have developed thereby creating an opportunistic scenario.