When there is growth in the wealth of a family and managing money that has crossed a certain threshold it becomes a difficult task to DIY and might result in loss of wealth and serious injury to family financial health. Let’s see how the Family wealth office provides a solution to managing wealth creation and preservation.

How does a family wealth office function?

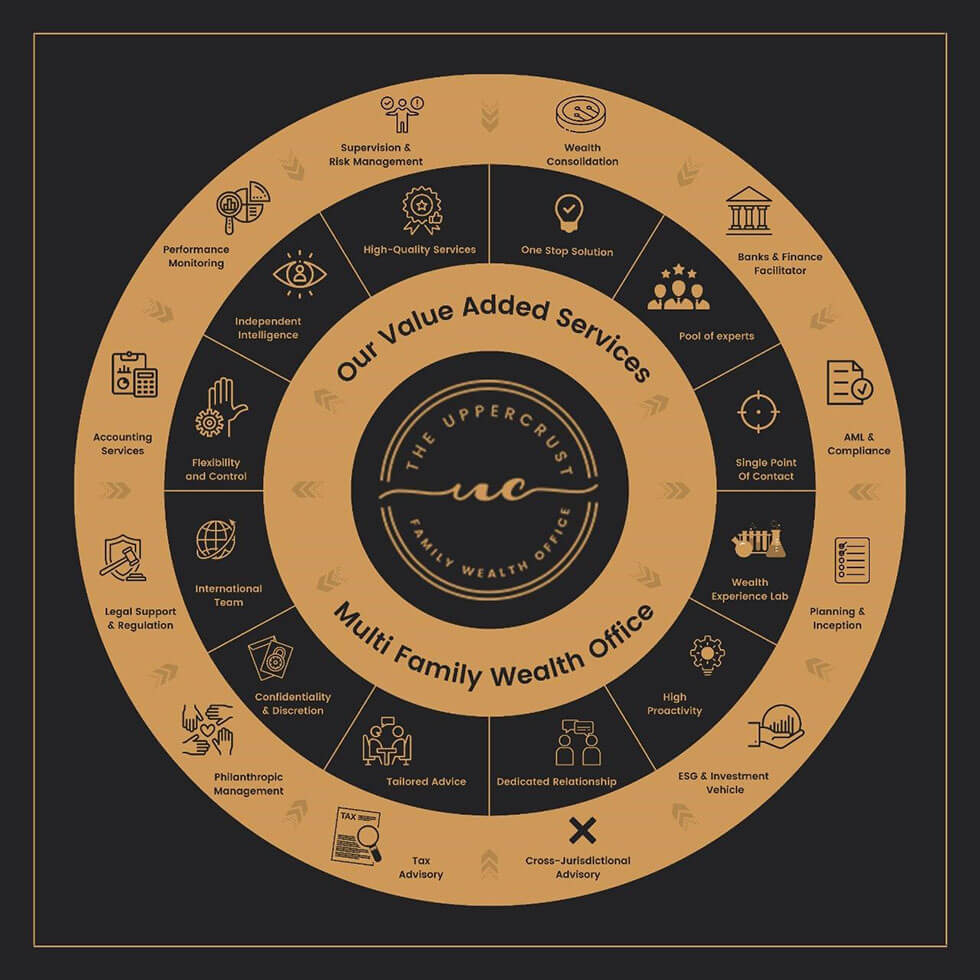

- Family offices are wealth management advisory firms that serve ultra-high net worth investors and provide complete financial advice and solutions.

- Family offices provide clients with legal, insurance, investment, estate, business, tax, lifestyle, and even philanthropy-related advice.

- Family offices are either a single-family office run by a family member or an appointed CFO who looks after one family’s wealth or multi-family offices run by professionals who serve more than one family.

- It is important that the objective of the family office is defined clearly and resonates with the entire family for it to function smoothly.

- Typically, the decisions of the family office are approved by a family council before execution and this process is followed to ensure trust and transparency.

Reason why someone should select a family office:

- It is personal and tailored to the need of the Individual family.

- It serves a privacy purpose. All the necessary data and information of the family is safe and secured at one location. Serves as gatekeeper and guardian to the family’s financial life.

- It just doesn’t serve the single purpose but over purpose of family for perpetuity.

- Serves the purpose of wealth creation for the next generation of family and at the same time current financial needs of the family. Overall prosperity is provided by the family office.

- Family office consists of experts and people with specific skills and competencies. Family office involves professionalism.

By looking at the reasons it is a good choice to go for the wealth management solution by the Family wealth office as mentioned above.

Creating and managing a family office may seem a daunting task. After all, it is another organization that needs staffing and oversight. Compared with the status quo—which is often the delegation of wealth management to various banks and asset managers combined with a lack of attention to other important family matters—a family office is considered an additional layer of complexity and cost. Given the various financial and non-financial benefits, however, with increasing wealth and complexity, not having a family office is often more costly than having one in the medium- to long-term.

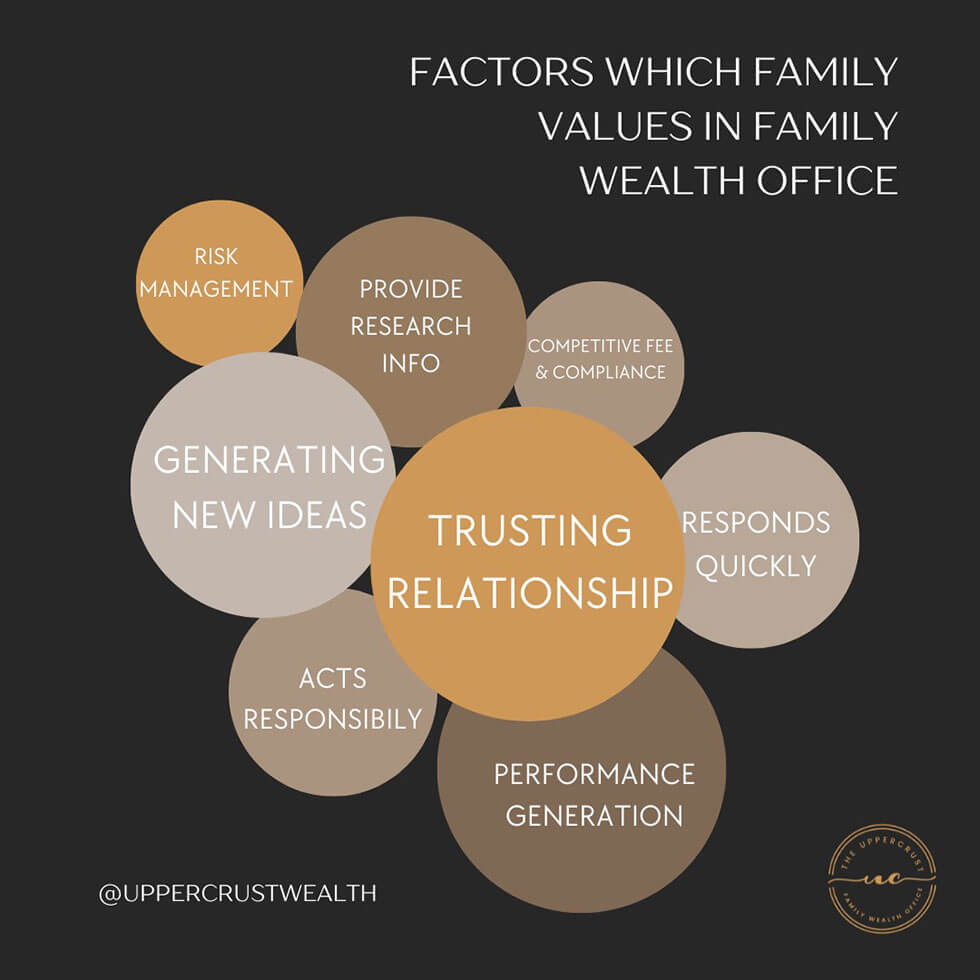

Factors that are important for the family while selecting a Family Wealth office.

The best place to start when considering a family office is to articulate the family office’s goals and vision—whether that is value creation, achieving long-term strategic objectives for the family, or other combinations. Consider what the family actually needs—right now and over the next 5–10 years. Avoid making these directional decisions in isolation among only one or two people; instead, use this as an opportunity to have family-wide conversations about the family’s future.

A family doesn’t need to build its own wealth management firm or provide all of the services.

Get in touch with UpperCrust Wealth to start your Family wealth journey.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.