Everyone talks about the Money, Investments, Wealth, Savings, Portfolio and also knows the importance of the same. But creating a wealth, building a portfolio is it that easy? The answer is Yes and No both. May be someone can start the investment process by getting influenced through various sources but to keep that continue for a long period and constant inflow of money is the biggest task which everyone cannot carry.

Building an investment portfolio can seem intimidating to those who are just beginning their investment journey. It can be challenging to set aside sufficient funds each month, while also budgeting for various expenses such as rent, equated monthly instalments (EMIs) for vehicles, and other obligations. However, the earlier you begin investing, the more time there is for your portfolio to mature and grow.

The most important aspect of building a portfolio is to balance growth opportunities with risks. The trick lies in understanding your own risk appetite while building a diversified portfolio and also investments should be mapped along with a specific goal. Selecting investments and diversifying your portfolio complement each other or they look similar at times. You should choose investments diligently if you want to diversify your portfolio well. If you want to diversify your portfolio you should pick investments judiciously.

Warren Buffet said, “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

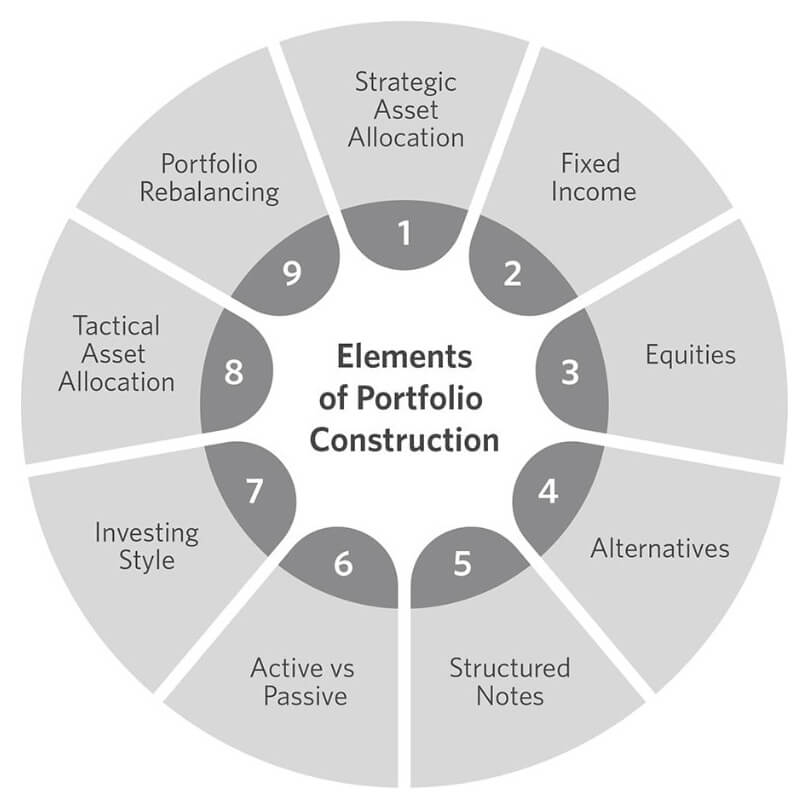

Criteria to Choose Investments

Answer the following questions before you sit down to pick your investments. What is your investment horizon? What returns are you seeking to achieve? What amount of risk are you able to take? What amount of funds are available for you to invest? What are the goals of these investments? The answers will guide you toward making intelligent investment decisions.

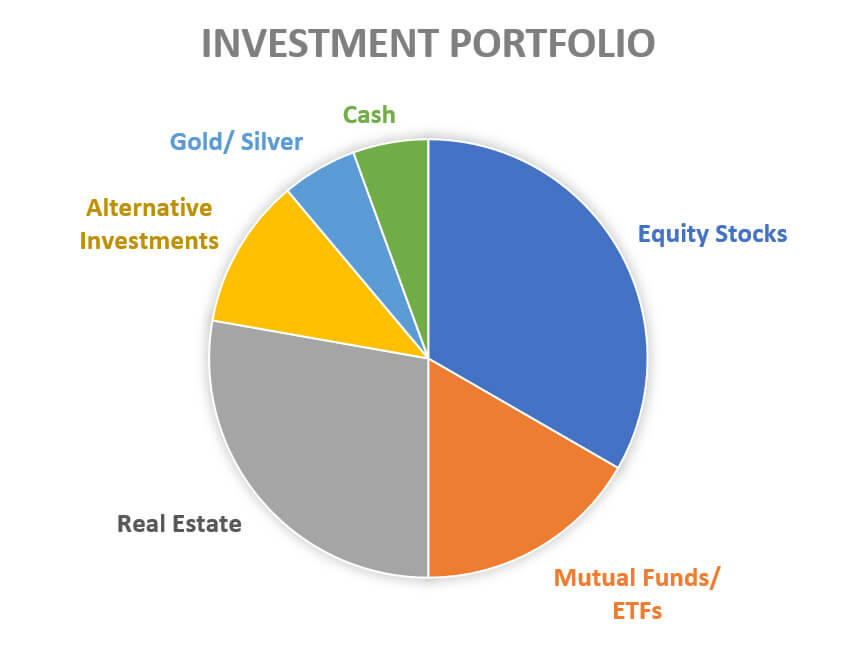

You may start with the breakdown of your proposed investments between cash, Equity (Shares, MFs, ETFs), fixed-income securities, and Alternative investments. The breakdown of your asset allocation ultimately depends on your risk tolerance and expectation of the returns. Now so many options are open and available for a Retail Investor to start an Investment journey.

Underlying Factors to be considered

There’re only two ways to create a wealth, one is to constant money inflows and give time till the targeted period without any fail for a long term. Products, returns, risks all are secondary factors to look upon. Some important factors those need to be considered as part of your investment filtering process are:

Tenure

You should evaluate the investments from the angle of return and growth in the short-term and long-term horizons to help you take an ideal decision. To put it in another way, this is a growth vs income option – short term is income and long term is growth which can give you tremendous returns through compounding.

Goal or purpose

You should have a clear-cut financial goal for your investments. In other words, life milestones like wanting to build a corpus for a child’s education, buying a house, planning for retirement, etc. are examples of your goals.

Liquidity

No doubt that cash is the most liquid investment but it comes with no return or growth, rather it depreciates if held for long period. Some assets like real estate may provide higher returns, but is a most illiquid asset. Clarity on your goals and horizon will help you make decisions on investments based on liquidity.

Risk

Arguably the most critical factor. The risk and return go together. The more the risk, the more the return and vice-versa. The choice of investment should match your risk profile. A conservative investor would not be comfortable investing all or a large portion of his/her money in high-risk investment options.

Taxation

Certain types of investments are tax-efficient. However, investments in such instruments should be a part of your overall financial planning and not the ultimate purpose of your investment. What you count as your return should be your post-tax return.

Investment Strategy

Investing your money without an investment strategy is like a sports team going into a game without a game plan. Having an investment strategy will help you discard many potential investments that may result in loss or that are not ideal for achieving your goal.

It is also important to quantitatively figure out your goal. Simply stating that you want to make money or maximize your wealth is not an investment strategy but something like having a corpus of a certain amount to retire by a certain age is a specific and quantitative investment strategy.

You must decide what type of investment you need to make to achieve your financial and life goal. Here are some of them:

Value Investing

The principle behind this investment strategy ‘buy and hold’ made popular by Warren Buffet is – to buy shares that are cheaper than they should be and hold them for a few years to enjoy the power of compounding in the returns.

Income Investing

Income investing involves buying securities that generally pay out dividends and return regular fixed income. Bonds, debentures, bank and money market deposits are the best-known examples of fixed income products, but dividend-paying shares, ETFs, MFs, and Indexes are other forms of income investments though they are not fixed-income.

Growth Investing

Growth investors focus on companies that generate above-average growth, through revenues and profits, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios.

Socially Responsible Investing

Also known as environment, social and corporate governance (ESG) and Impact Investing though not strictly the same, this is about investment in socially responsible companies that make a profit. SRI is one path to seeking returns that benefit everyone. India is the first country in the world that has made CSR mandatory for companies that have crossed a certain threshold.

Different Avenues:

Different Investment options to start your Investment Journey:

- Direct Equity

- Mutual Funds & ETFs (SIP or Lumpsum)

- Alternative Investment options

- Fixed Income generating options

- Gold/ Silver

The purpose of an investment portfolio is to ensure your financial stability and independence. It allows you to plan for emergencies, ensure regular income, and provide you with the financial freedom to meet your expenses. By setting aside adequate savings each month, we also gain financial discipline and the self-confidence for making judicious decisions regarding finances and future planning. One should make his investment portfolio in such a way that after some years that portfolio should start generating some passive income to the investor.

Happy Investing

The author is Certified Financial Planner (CFP) and CA finalist. He’s working as an AVP Alternative Wealth at Uppercrust Wealth Pvt ltd. also handling Financial Planning and Alternative Investment desk.