Overview

Why should one need to Invest? Investing ensures present and future financial security. It allows you to grow your wealth and at the same time generate inflation-beating returns. You also benefit from the power of compounding.

In India when we think about Investments, generally we go for the products like Equities, Mutual funds, bonds, Fixed Deposits, commercial properties, land, etc. So these all are traditional or conventional products which are being used for the investments purpose. All these popular products have their own pros and cons and Investors still need some better solutions for the cons.

Why to consider investment in AI?

Diversification is one of the fundamental principles of investment. It reduces risk and helps in minimizing the losses. This is where your portfolio needs Alternative investments in your portfolio. These investments are a little different from traditional ones, and prudent investment in them can help you achieve various life goals. With low correlation to traditional asset classes, alternatives can be a beneficial way to diversify your portfolio. An alternative investment is a financial asset that does not fit into the conventional equity/income/cash categories.

Alternates VS Conventional/ Traditional

In India initially debt and fixed income products were generating inflation beating returns and people were also very fine and happy with it. In equities and kind of products they are getting a good double digit returns for wealth creation but that also come with high risk and volatility which many of Indian Investors don’t prefer. That is where the need of Alternative Investment arrives, where an Investor gets equity kind of returns at debt kind of managed risk. Let’s say, under the fixed income space Investors are getting max around 7-8% p.a. (safer investments like Bonds, FDs, other deposits, etc.) and in equities they are getting returns in long term on an average around 12-16% p.a. range but along with good amount of risk and volatility. Now here the need of Alternative Investment arrives to fulfill the gap between 8%-12%, a risk adjusted returns at which most of the investors want to grow their portfolio.

Need of Alternative Investments

- Alternatives rely less on broad market trends and more on the strength of each specific investment; hence, adding alternatives can potentially reduce the overall risk of a portfolio. With low correlation to traditional asset classes, alternatives can be a beneficial way to diversify your portfolio.

- High Net worth Individuals (HNIs) who are looking to expand their investment portfolio can consider investing in AIFs, as the return potential is very high, accompanied with an equivalent amount of risk. AIFs invest in securities that go beyond the traditional investments such as stocks, bonds, mutual funds, etc., paving a way for investors to expose themselves to alternative securities that deliver higher returns.

- Initially the alternative baskets were only available to HNIs and UHNIs in the form of AIFs. Now the individual components of AIFs are available to retail public too in the form of various alternative investments options. So now a retail investor can also take exposure of Al with lower ticket size.

- A traditional “60/40” allocation to equities and debt may no longer be enough to meet long-term investment goals. Alternatives can help to lower volatility, enhance returns and broaden diversification of a portfolio.

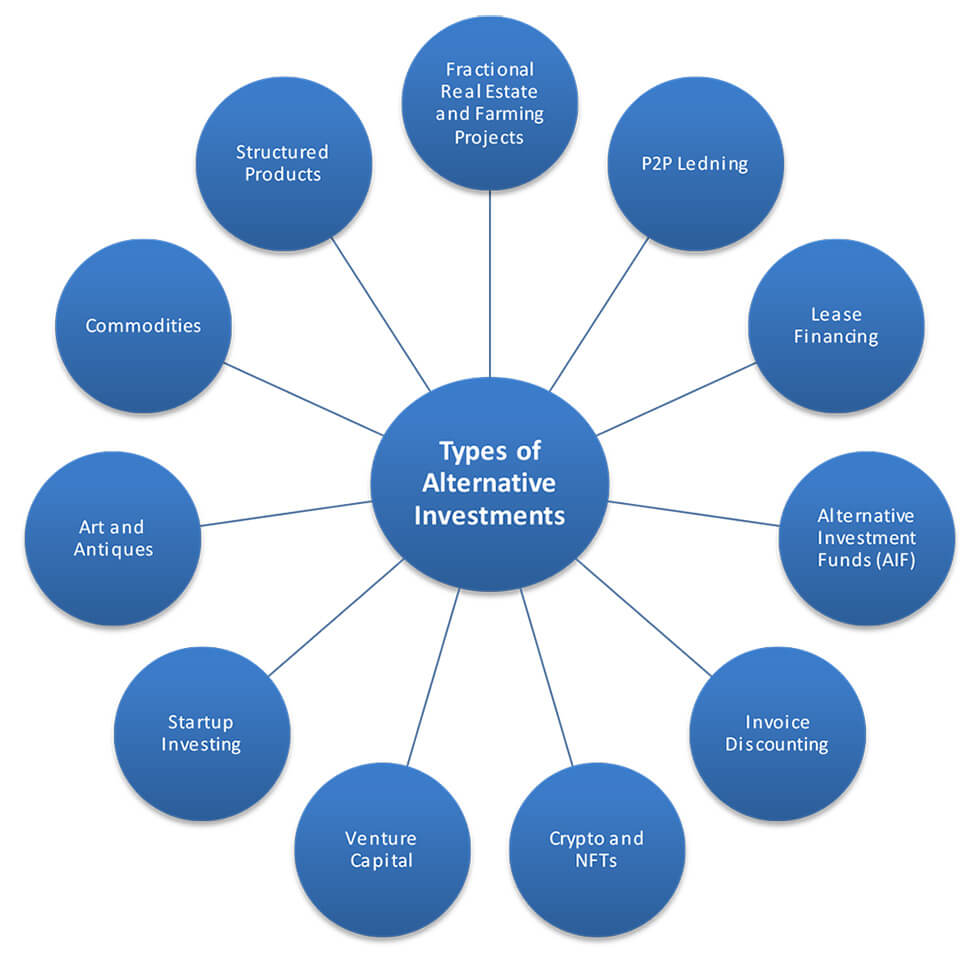

Types of Alternative Investments:

Are Alternative Investments Safe?

Every investment whether it is traditional or new aged, carries its own benefits and risks. Mostly Alternative Investments are not regulated but there are few which are regulated by the regulatory authorities like RBI, SEBI, etc. Therefore, it is important to invest with the advice of a trusted “Financial Advisor” or do your proper due diligence if investing on your own.

Benefits

- Regular passive income

- Lack of volatility

- Broader Diversification

- Tailored and Structured as per requirements

- Uncorrelated to the Stock Market

- Direct ownership

- Tax benefits

- Easy access and usability

Risk

- Lack of Liquidity

- Higher ticket size

- No standard valuation methods

- Lack of regulations and controls

- Lower public acceptance and not guaranteed returns

Conclusion

Alternative investments are one of the best ways to diversify your portfolio. Most alternative investments can generate passive income, which can be useful for post-retirement expenses and for paying recurring subscriptions and bills.

One should diversify upto 20% of his/her total portfolio to Alternative investment Options. Though Equities and other asset classes will give good returns but in next decade “Alternative Investment Options” will be in core focus and emerge as one of the best Investment options.

The author is Certified Financial Planner (CFP) and CA finalist. He’s working as an AVP Alternative Wealth at Uppercrust Wealth Pvt ltd. also handling Financial Planning and Alternative Investment desk.