The active funds versus passive funds debate refuses to die down. In the past 6-8 months, I’ve come across a few reports and articles published by the media questioning the efficacy of actively managed equity funds. Besides, against the backdrop of several Index Funds being launched in the last few months, I even heard some experts playing up the tune of passive funds.

Are passively managed Index Funds the apt fit to generate wealth? Let’s find out…

Well, first understand that the performance of active equity funds and Index Funds could vary depending on the type of scheme, the benchmark it tracks, and the timeframe you select.

If assessed over the last one year, surely certain sub-categories of actively managed equity mutual funds — like Large cap Funds, Large & Midcap Funds, Multi-cap Funds, Flexi-cap Funds, and ELSS — have underperformed the Nifty 50 Index Funds, the BSE Sensex Index Funds and the Nifty 100 Index Funds as well as the benchmark indices (see Table 1).

Only Value Funds and Contra Funds (which follow certain value investing principles) have fared better than index funds and benchmark indices, yielding value for you, the investor, in the last one year.

Table 1: Performance of various mutual fund categories across the timeframes

| Scheme Name | Absolute (%) | CAGR (%) | Risk-Ratios | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 6 Months | 1 Year | 2 Years | 3 Years | 5 Years | 7 Years | Std. Dev | Sharpe | Sortino | |

| Active Equity Funds | |||||||||

| Smallcap Funds | 8.9 | -1.2 | 27.5 | 28.7 | 12.7 | 18.5 | 22.85 | 0.12 | 0.30 |

| Contra Funds | 11.4 | 6.6 | 19.4 | 22.0 | 13.1 | 17.6 | 23.25 | 0.23 | 0.35 |

| Midcap Funds | 6.9 | -0.1 | 19.2 | 21.3 | 11.6 | 16.7 | 19.37 | -0.06 | 0.14 |

| Dividend Yield Funds | 9.8 | 3.2 | 18.7 | 19.2 | 10.6 | 15.7 | 19.64 | 0.22 | 0.35 |

| Value Funds | 11.7 | 4.2 | 17.6 | 18.6 | 9.5 | 15.2 | 22.00 | 0.16 | 0.25 |

| Large & Mid Cap Funds | 7.8 | -0.5 | 16.3 | 17.4 | 11.0 | 15.8 | 21.25 | 0.18 | 0.27 |

| ELSS Funds | 8.4 | 0.0 | 14.0 | 16.0 | 10.1 | 15.1 | 20.51 | 0.14 | 0.21 |

| Flexi Cap Funds | 7.5 | -1.6 | 13.5 | 16.0 | 11.0 | 15.2 | 19.54 | 0.13 | 0.20 |

| Focused Funds | 7.4 | -0.9 | 13.4 | 15.8 | 10.3 | 15.2 | 20.17 | 0.16 | 0.26 |

| Large Cap Funds | 8.5 | 0.6 | 11.9 | 14.3 | 10.5 | 14.2 | 19.02 | 0.01 | 0.15 |

| Multicap Funds | 8.5 | 0.6 | 11.9 | 14.3 | 10.5 | 14.2 | 14.89 | -0.42 | 0.01 |

| Index funds | |||||||||

| Nifty-50 Index Funds | 9.4 | 2.6 | 12.0 | 14.7 | 11.5 | 14.6 | 21.32 | 0.13 | 0.21 |

| Nifty Next 50 Index Funds | 5.5 | -1.7 | 11.6 | 13.6 | 6.5 | 13.5 | 19.98 | -0.26 | -0.01 |

| S&P BSE Sensex Index Fund | 9.8 | 3.0 | 11.2 | 14.4 | 12.2 | 14.9 | 21.75 | 0.13 | 0.19 |

| Nifty 100 Index Funds | 8.6 | 1.9 | 12.0 | 14.7 | – | – | 18.75 | 0.05 | 0.05 |

| Nifty Midcap 150 Index Funds | 8.8 | 0.0 | 19.3 | 21.9 | – | – | 20.51 | 0.09 | 0.15 |

| Nifty Smallcap 250 Index Funds | 7.3 | -8.7 | 21.4 | 21.7 | – | – | 24.45 | 0.06 | 0.13 |

| Nifty 500 Index Funds | 8.5 | 0.7 | 13.4 | 15.9 | – | – | 23.00 | 0.16 | 0.24 |

| Benchmark Indices | |||||||||

| NIFTY 50 | 9.1 | 1.5 | 11.0 | 13.8 | 10.6 | 13.8 | 22.87 | 0.14 | 0.20 |

| NIFTY 100 – TRI | 8.8 | 2.1 | 12.3 | 15.1 | 11.3 | 15.1 | 22.75 | 0.15 | 0.22 |

| Nifty Midcap 150 – TRI | 8.8 | 0.5 | 19.8 | 22.1 | 10.9 | 17.7 | 25.98 | 0.23 | 0.35 |

| NIFTY 500 – TRI | 8.8 | 1.1 | 14.0 | 16.5 | 10.8 | 15.4 | 23.28 | 0.17 | 0.25 |

| Nifty Smallcap 250 – TRI | 8.7 | -8.1 | 22.6 | 22.6 | 6.0 | 14.4 | 30.48 | 0.22 | 0.33 |

*Performance as of 20th January 2023. Category average returns are considered for each category. Returns are Point to Point and in %, calculated using the Direct Plan-Growth option.

Past performance is not an indicator of future returns. Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

(Source: ACE MF, PersonalFfN Research)

As per SPIVA analysis as of June 2022, the percentage of actively managed equity schemes underperforming their respective benchmarks varied between 27%-90% on 1-year returns, depending on their market capitalization bias.

In my view, an active equity mutual fund scheme’s performance cannot be evaluated by looking at short-term returns, irrespective of whether a Large Cap Fund, Large & Mid Cap Fund, or any other sub-category of equity scheme.

A longer period of performance, i.e., over 3 years, 5 years, 7 years, or more, gives a better sense of how an actively managed equity mutual fund scheme fares across market cycles or phases. The SPIVA study also reveals that over the longer time frames (3 years, 5 years, and 10 years), the proportion of underperformance of the actively managed equity schemes is lower.

Thus, only when the CAGR returns across market phases or cycles are remarkably low than the category peers, Index Funds, and the benchmark index, the actively managed equity mutual fund scheme may be given a miss. Keep in mind that it is not that all active equity funds are bad or should be given a miss. Some actively managed equity funds have generated alpha, i.e., outperformed their respective benchmarks and Index Funds. What matters is prudent fund selection if you are looking to generate wealth.

Enterprises, which replaced Shree Cements in the Nifty 50 Index in September 2022. Adani Enterprises is estimated to have witnessed USD 335 million in inflows when it was added But still, the question remains: Why did passively managed Index Funds outperform?

It might sound ironic, but passive funds aren’t really passive these days. This is because their underlying indices witness a high churn these days. In other words, the constituents or the companies forming a part of the index are removed and replaced with some other quite often.

The primary criteria for inclusion in the Nifty 50 Index are:

- Average free-float market capitalisation should be at least 1.5 times the average free-float market capitalisation of the smallest index component.

- The average impact cost of the security should be a maximum of 0.5% for the last six months on 90% trading instances for a portfolio value of Rs 10 crore.

Up to 5 companies can be replaced/added in a calendar year.

Given the market movement in the last couple of years, any stock in the Nifty Next 50 Index, which has a high free-float market capitalisation and has done exceptionally well in the recent past, has become a potential candidate for inclusion in the Nifty 50 Index, especially, when it can easily satisfy the liquidity criterion. Take the example of Adani to the Nifty 50 Index in September 2022 (and the average annual return of Adani Enterprises in the past 3 years has been 165%).

But what about valuations, rising debt on the balance sheet, and corporate governance issues that may have deterred a vast majority of active equity fund managers from investing in Adani Enterprises? In my view, adding such companies to a portfolio is always a tough call for any fund manager of an actively managed equity fund.

When such stocks are added to major indices and sentiments are upbeat, their movement becomes further skewed on the upside. And in such a case, if an actively managed equity scheme does not own such a stock — because it does not fit in the quantitative and qualitative parameters of the active fund manager — it could weigh down on the returns of the scheme.

What’s more amusing is Shree Cement replaced Yes Bank in March 2020, and the former’s tryst with the Nifty 50 Index came to an end in just two-and-half years with Adani Enterprises making its debut in the Nifty 50 Index.

Another reason why active fund managers struggled to match the performance of passive funds lately is the dominant weight of select stocks in the leading indices. Between December 2019 and December 2022, the weight of Reliance Industries Ltd. in Nifty 50 jumped from around 8.6% to almost 11%. Active equity fund managers tend to prune single stock exposures when they near the 10% mark, whereas an Index Fund can remain passive and follow the weightage of the underlying benchmark index.

On the flip side, a noticeable underperformance of some of the index-heavy private sector financial stocks negatively affected the performance of active funds betting big on them. For instance, HDFC Bank, HDFC Ltd., and Kotak Mahindra Bank, amongst others, witnessed erosion in their index weight. Historically, these banks have delivered consistent business growth, and their asset quality has been stable too. But taking a low risk in a high-risk environment could result in underperformance.

Similarly, in the S&P BSE 500 Index, 3 of the top 10 performers in 2022 were Adani group companies: Adani Power, Adani Enterprises and Adani Total Gas. All of them are capital-intensive and subject to cyclicality.

Amongst 448 of the S&P BSE 500 companies that have been part of the index for the past three consecutive years, 161 companies generated appealing double-digit returns in the year 2022, while in the year 2021, the count of such companies was 322.

This broadly suggests broader markets have performed fairly well, but owing to the limitation of an active fund manager to hold the number of stocks in the portfolio, it may not have yielded much benefit to their active equity funds. Besides, amongst the index heavyweights, only a few stocks drove the market movement in 2022. Nevertheless, it helped the Indian market to outperform its global peers quite convincingly in 2022.

Another problem with frequent index churning is some sectors get heavily underrepresented, and when top performers replace laggards and cyclical stocks, the Price-to-Equity (PE) ratio of the index undergoes a change. For instance, Tata Consumer Products replaced GAIL in 2021 and Divis Labs replaced Bharti Infratel in September 2020—high P/E stocks replaced low P/E stocks.

Rejig in other indices has been more radical. The change in the eligibility criterion to be a part of an index, which allowed the inclusion of companies having a listing history of just one month, cleared the way for newly listed loss-making platform companies. Recently listed new-age platform companies such as One 97 Communications (Paytm), FSN E-commerce, and Zomato today have found a place in the Nifty Next 50 Index attributing to sky-high valuations. But since their listing, they have been falling relentlessly. Falling liquidity and the end of the lock-in period applicable to anchor investors affected have weighed down on their performance. Suddenly investors started fretting over the lack of profits, but the fact is, these companies were never making profits.

So, as elucidated above, there have been a variety of factors that have led to the underperformance of some of the actively managed equity mutual fund schemes in the last year.

In my view, fundamentally, investors who are happy with market returns may invest in passive funds. But if you wish to outperform the equity markets (the benchmark index returns), prefer actively managed equity funds. Over the long term (5 years and more), actively managed equity funds can generate alpha returns for you.

Factors that create alpha opportunities are:

- Efficiencies in portfolio management

- Asymmetry in the information available to different market participants

- Diverse interpretations of the information by different investors

- Investment processes and systems

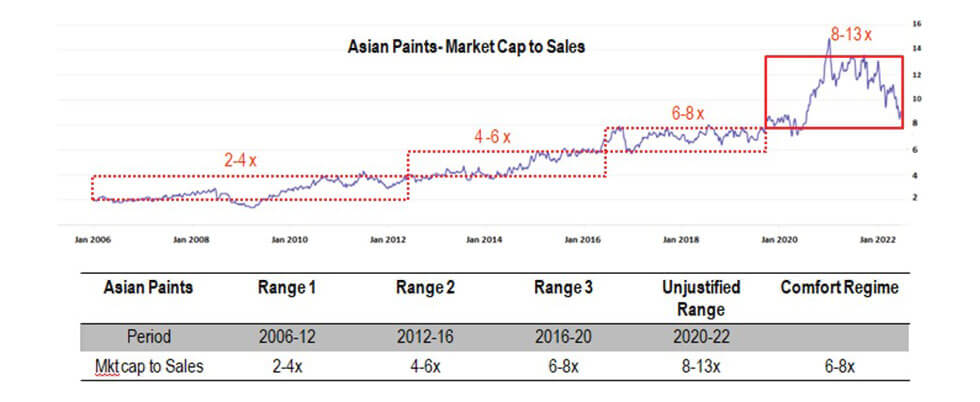

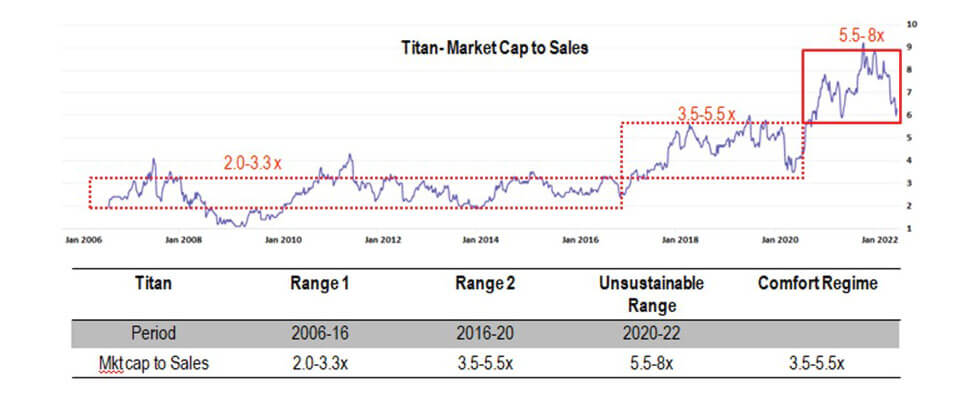

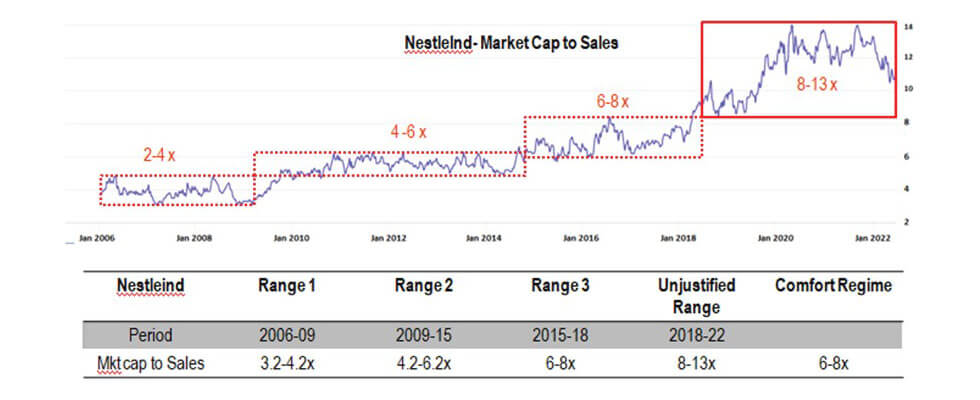

With the advent of technology and sophisticated analytical tools available to investors, new developments get factored into stock prices really quickly. In a way, markets seem to have become more efficient nowadays. This is one of the fundamental reasons why I believe alpha opportunities have become few. Moreover, liquidity has become an even more critical aspect guiding the valuations rather than the other way around.

The entire story of P/E expansions that unfolded over the last 10-12 years despite weaker earnings, can be attributed to very high liquidity and ultra-low interest rates. During this time period, actively managed equity funds that cared about valuations and margin of safety over ‘growth’ have looked like underperformers.

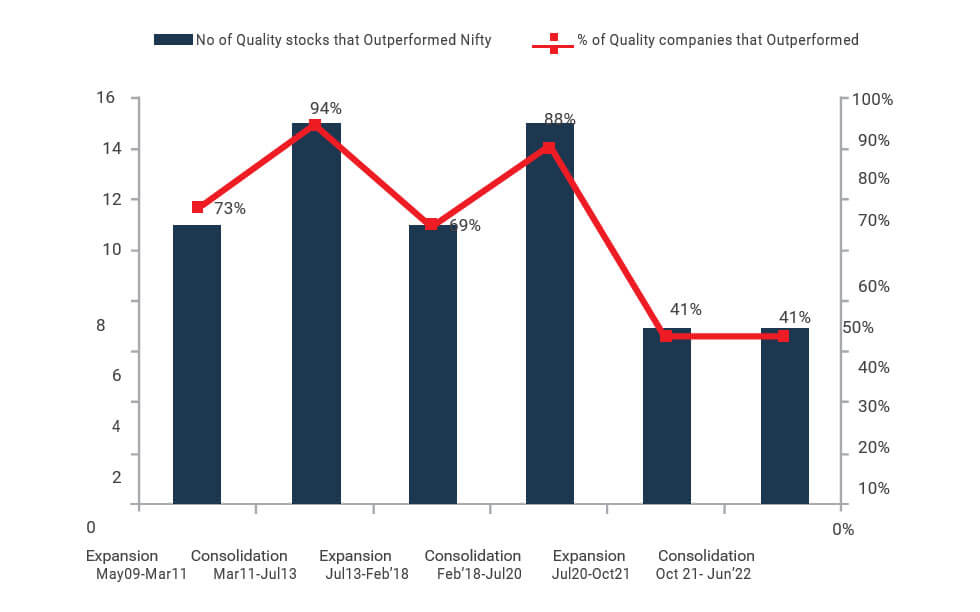

That being said, certain actively managed equity funds may be holding a quality portfolio, but it is possible that the sector bets (due to cyclicality) may not have paid off. For instance, the larger IT companies and pharma didn’t move much in 2022, as they did in 2020 and 2021. So, those active equity funds with exposure to such companies lagged, while those who indulged in sector rotation and momentum play, fared better.

Likewise, active equity funds that stayed away from Initial Public Offers (IPOs) — perhaps finding valuations a concern — but the company listed at impressive listing gain and rally that continued during the initial days of listing, lost on to the opportunity. Also, the ones who participated in IPOs but had to live up to a post-listing loss took a hit.

Thus, the underperformance of some actively managed equity funds in the last one year shouldn’t be blamed entirely on the market dynamics. Some active fund managers grossly misread market conditions. They refrained from investing in value companies, avoided cyclical stocks entirely, failed to realize the opportunities in midcap IT companies, and missed rallies in PSUs. Additionally, specific biases of fund houses and fund managers could be one of the reasons for underperformance.

Also, the Index Funds with exposure to the laggards in the respective index, too have suffered. So, keep in mind, a passively managed Index Fund could also expose you to high risk as well.

The point is, it’s not that all active equity funds can create wealth for you, particularly in the short term. If you select active equity mutual fund schemes with robust stock selection methodologies, the potential to generate alpha, i.e., outperform the benchmark index (as well as Index Funds) is higher. Timely identifying and including businesses with quality management that can deliver growth with the best corporate governance practices can augur well for the performance of an active equity fund to generate superior returns over the long term. In Table 1 above, the 3 years+ returns of active equity funds across sub-categories have been quite appealing and better than the benchmark returns and Index Funds.

Here are a few rules to follow to select active equity mutual funds for alpha-boosting returns:

- The portfolio should be built with a time horizon of at least 5 years.

- Diversify across investment style and fund management.

- Each fund in the portfolio must be true to its investment style and mandate.

- The active equity funds are managed by experienced and competent fund managers and must belong to fund houses that have well-defined investment systems and processes in place.

- No two schemes must be managed by the same fund manager.

- There should be no more than two schemes from the same fund house in the portfolio.

- Each fund should have seen at least 3 market cycles of outperformance and has proven the ability to generate alpha over the market index.

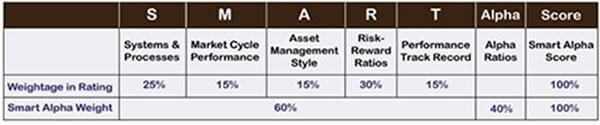

- They are amongst the top scorers in their respective categories.

With optimum weightage to each quantitative and qualitative parameter, which we consider important in identifying fundamentally strong funds with the potential to generate alpha, this model helps to zero in on quality names that have the ability to generate alpha returns for investors over the long term (over 5 years).