“Finance planning is the golden key to achieve your goals”

Every human here is after “Money”. And yes we have to, in order to live a lifestyle that we have imagined. There is never ending list of dreams to be fulfilled such as buying a luxurious car, a dream home, vacations and much more.

But, how many of you have dreamed to be financially independent by a certain age? Well, I assume very few of you.

Through this blog, my only motive is to let people know that how important financial literacy is for everyone.

What is financial planning and why is it important?

A financial plan creates a road-map for your money and helps you achieve your goals. It is a planning of your hard earned money. Financial planning includes budgeting your expenses, investing in right assets, setting smart goals, selecting right asset allocation, creating a retirement plan and much more.

Planning is a dynamic process. Financial planning is important because it guides and controls the financial decision making process. It helps you determine your short-term and long-term financial goals and create a balanced plan to meet those goals.

Right investment with proper planning helps to beat inflation which eats up your money and makes it undervalued over few years.

“Failing to plan is planning to fail”

Financial planning is for everyone

There’s disbelief that, finance planning is only for “Rich People” because they have money in abundance which need to planned and managed. But, that is not the case.

Financial planning is for everyone no matter if that individual is a student, salaried employee, middle class family, and individuals who are in their 30’s, 40’s or 50’s. Just like everyone needs to see a doctor at some point in life, the need is same here. Financial planning is important for every one of us and we should take it more seriously to better shape and safeguard our future.

Why planning for finance at early age is important?

When you start early, you can plan ahead of time for your future. Financial goals have the benefits of fulfilling your dreams when you desire. The reason being is that, you have longer time horizon to spread out your investments and manage your portfolio across time.

“The early you start saving and investing your money. The early you can plan your retirement.”

How a financial planner/advisor can help an individual?

If not early then definitely at a certain point in life every individual will have these questions.

- What is the amount of life insurance that I need?

- How much should I save for retirement?

- What types of investments should I own?

- Is there a way we can save on taxes?

If you have any of these questions on your mind then definitely a qualified financial planner/advisor can come to your rescue. A financial planner can help you determine how much you need to invest each month and make recommendations on the type of investments you should make to reach those goals. Choose your financial planner carefully who can understand your needs and devise a plan that will lead you throughout your professional life to retirement.

Financial planning- Rule of thumb (Tips for beginner’s)

Income – Savings = Expense

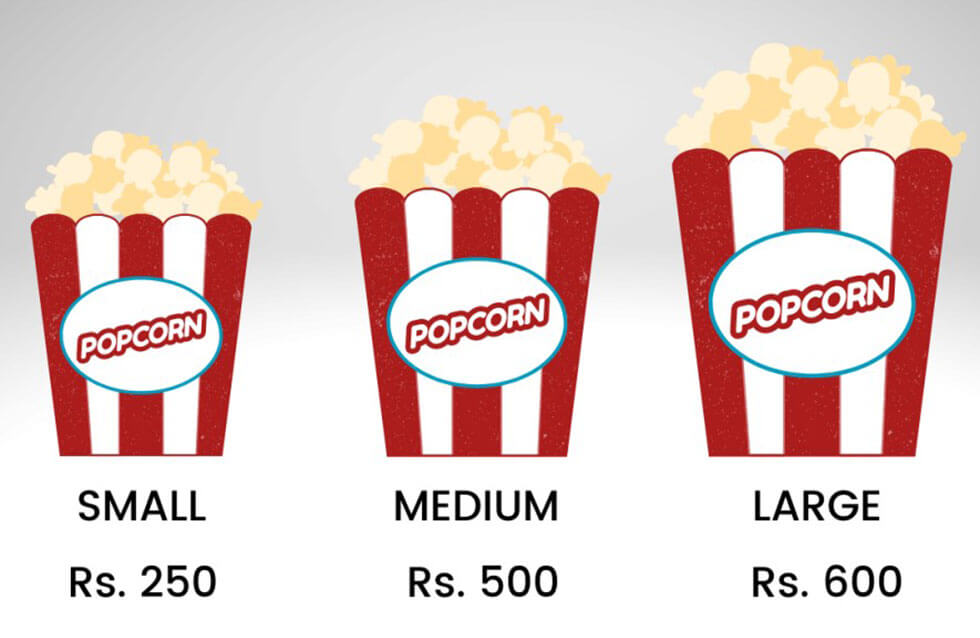

50-30-20 budgeting method offers a great framework. It breaks down like this:

- 50% of your income should go towards living essentials such as food, rent, utilities, bill, and transport.

- 30% towards wants like- dining out, shopping, membership, subscription, vacations.

- 20% should go towards savings i.e. short-term goals and long-term goals like retirement, children education and their marriage expense.

To sum it up it would be right to say that financial planning ensures that you are in complete control of your finances, income, liabilities and know exactly what you need to do if a certain situation comes up.

“Don’t just make money. Make your money work for you.”