Interest in ESG has never been higher and pressure is on investment organizations to move towards the sustainable investing model as the world shifts from ESG as an Idea to Reality. From Institutional investors to retail investors ESG is on top of the mind and growing. 90% of investment professionals expect their firm’s commitment to ESG will increase, citing the need to manage risk and respond to client demand.

So the question is what exactly is ESG? How does it dictate the investing method?

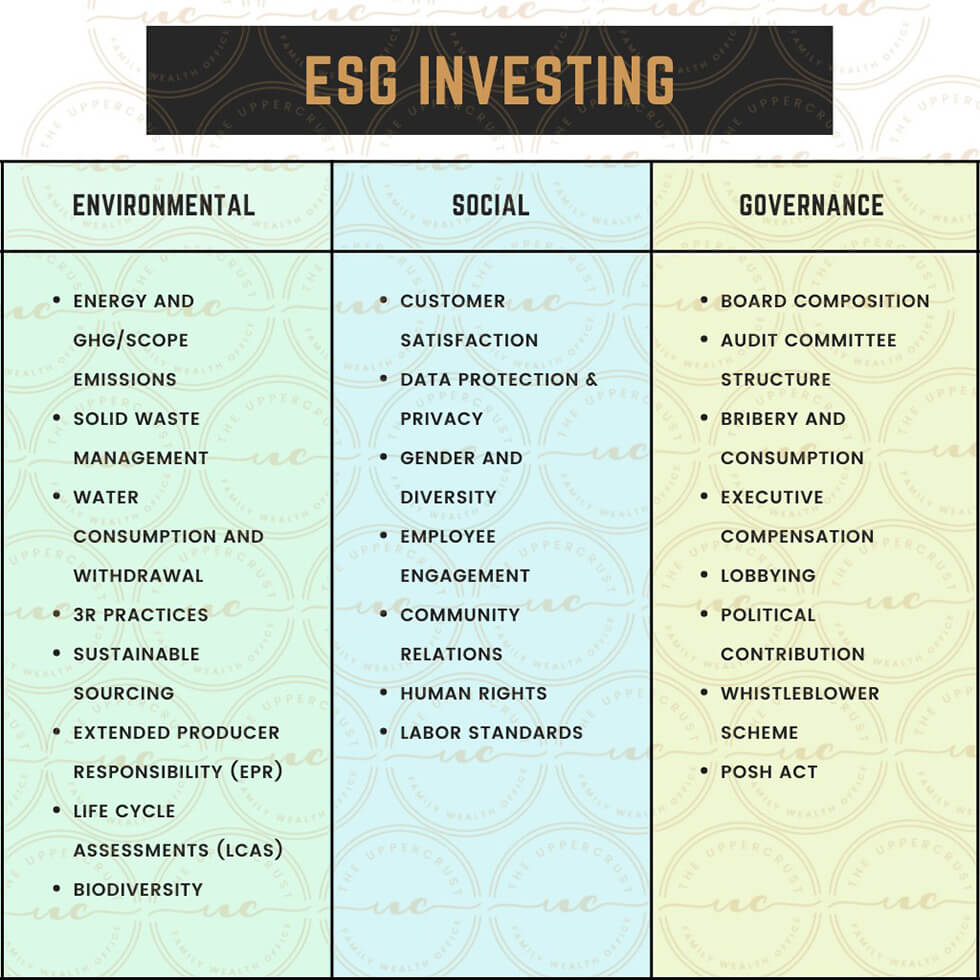

ESG stands for Environmental, Social, and Governance. Investors are increasingly applying these nonfinancial factors to their analysis process to identify material risks and growth opportunities. ESG metrics are not a mandatory part of Financial reporting, though companies are increasingly making disclosures in their annual or standalone sustainability reports. Numerous institutions, such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD) are working to form standards and define materiality to facilitate the incorporation of these factors into the investment process.

Due to the growing focus of companies and investors on ESG, the Indian government is also giving importance to being at the forefront of ESG focus metrics reporting. SEBI recently replaced the Business Responsibility Report (BRR) with the new Business Responsibility and Sustainability Report (BRSR). BRSR is applicable to the top 1000 listed companies by market capitalization and is mandatory for the financial year 2022-23 i.e., from 1st April 2022.

ESG investing involves analyzing these 3 considerations into financial models. These are done in 2 ways:

- Negative screening/Exclusionary investing: It means removing companies from the list of the universe of stock of investing based on certain traits which investors looking to avoid, firearms, alcohol, and gambling, or other time it involves removing companies that are showing red flags like those with the history of human rights violations, committed fraud.

- Positive Screening/Inclusionary investing: It means being proactive more proactive and looking to invest in companies that are actively benefiting or supporting positive initiatives while operating their business this includes renewable or green investing where investors put their money behind wind solar and other sustainable energy companies as well as investing in companies with more equal opportunity employment practices.

- Impact Investing: Invests in a company that attempts to deliver a measurable social or environmental impact alongside Financial Returns.

There are other styles of investing which are used in ESG that are: Best in class, Thematic investing, and Goal-based Investing. In India, 100% of respondents expressed interest or were already using ESG strategies—up from 96% in 2018 which was top of all the countries followed by China and UAE.

All these factors mentioned above are taken together and it evaluates ‘Is the business worth investing in?’ But investors should also keep in mind that it is able to perform financially too or else it will be like pouring money into charity.

Other strategies for socially conscious investing

While ESG offers one strategy for aligning your investments with your values, it’s not the only approach.

Socially Responsible Investing (SRI)

Socially responsible investing (SRI) is a strategy that also helps investors align their choices with their personal values. SRI presents a framework for investing in companies that agree with your social and environmental values.

Whereas ESG investing takes into account how a company’s practices and policies impact profitability and future returns, SRI is more tightly focused on whether an investment is more precisely in line with an individual investor’s values. ESG factors in corporate performance while SRI solely focuses on the investor’s values.

For example, if health and well-being are key values for you, one possible SRI strategy would be to completely avoid investments in companies that make alcoholic beverages or tobacco products. An ESG strategy might be fine with investing in tobacco or alcohol manufacturers so long as the companies’ social and management policies met high standards, and their environmental record was strong.

Impact Investing

Impact investing is less focused on returns and more focused on intent. With impact investing, investors make investments in market segments dedicated to solving pressing problems around the globe. These sectors could include those making advancements in green and renewable energy, housing equity, healthcare access and affordability, and more.

The Global Impact Investing Network (GINN) has four published guidelines for impact investments:

- Intentionality. Investments are made with the intention to affect positive social or environmental change.

- Investment with return expectations. Of course, investments should generate a return of capital at a minimum.

- Range of return expectations and asset classes. Different investment areas should have aligned expectations about returns. Sometimes these returns are below market rate.

- Impact measurement. Investments should have an exceptional level of transparency so investors can assess how their dollars help to achieve meaningful change.

Compared to ESG, impact investing may generate lower returns depending on the sector invested in due to concessions investors make to support earlier-stage ventures in less developed markets. However, for investors with a sincere interest in effecting social equity, impact investing offers a more direct approach to affecting change with highly focused investments.

Conscious Capitalism

Created by Raj Sisodia, a marketing professor, and John Mackey, the co-founder of Whole Foods, conscious capitalism is the belief that companies should act with the utmost ethics while pursuing profits.

The four guiding principles of the movement, as defined by Conscious Capitalism, are:

- Higher purpose. Profit for these companies is a reward for a well-built conscious company, not the end-all, be-all. They strive toward a higher purpose and more significant impact on the world beyond money and market share.

- Stakeholder orientation. A company and its leaders should develop an ecosystem that balances the needs of all stakeholders equally, not overweighting shareholder returns at the expense of other stakeholders.

- Conscious leadership. Leaders should work towards developing an inclusive culture and weigh equally the interests of all stakeholders in the business—from employees to shareholders to customers.

- Conscious culture. Companies should intentionally create a culture within their businesses that promote their values and purpose.

Conscious capitalism is strikingly similar to ESG—with one notable difference. The principles of conscious capitalism are typically embodied by the leader of a company, which often leads to them running a company with a high ESG score. Thus, when investors practice an ESG-guided investment strategy, they’re likely to choose companies that embody conscious capitalism principles.

So, to conclude, ESG investing is very important for an emerging economy like India as it provides an opportunity for all stakeholders to build an economy that is financially inclusive and measured by parameters beyond financial metrics. SEBI is indeed a visionary to facilitate the achievement of the United Nations Sustainable Development Goals and the Paris Agreement on Climate Change by way of mandatorily requiring ESG reporting by Indian companies. One hopes that the applicability of the BRSR reporting is extended to all listed companies and large unlisted companies.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.