Over 83% of Indian SMEs don’t have access to finance despite the government’s measures taken due to the pandemic. All those small businesses need access to credit to grow business. One of the biggest reasons for this gap is technological deficiencies or lack of knowledge. The challenges faced by small businesses in accessing credit include a lack of knowledge concerning business loan processes, adding that the majority of them have a scarcity of capital owing to restricted access to finance and credit. As many micro-businesses operate in remote and far-flung places, they also lack the essential technical knowledge required to avail of fast-paced digital loans

This problem especially seems like an opportunity to Fintech and they have come up with an innovative solution to ease the access to credit with help of technology. The gap which cannot be filled by conventional banks is being taken care of by Fintechs (Lending Fintech companies).

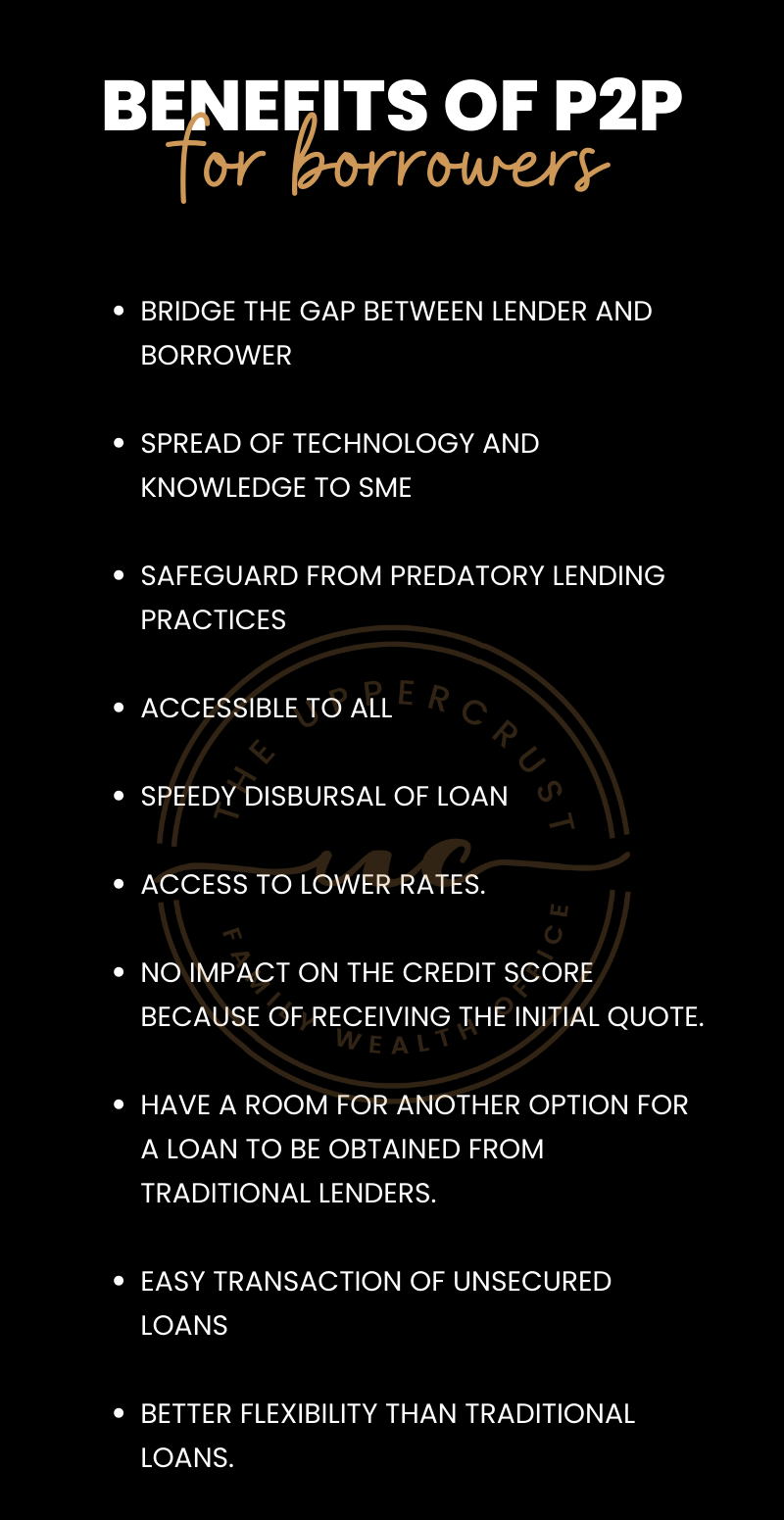

A lot of those Fintechs business models have resulted in 98% of loan recovery and mass access to credit to those small businesses who don’t have access to credit from the conventional formal source of lender. Earlier they had to get access to the informal sector which had a very high rate of interest and predatory lending practices.

Fintech which has penetrated this sector is a P2P lending company with unique business models. This has given investors a good opportunity to diversify their portfolios. Fintech has also lowered the risk due to good government support and regulations which have helped them to increase the business multifold times in the short term of time. These measures have been taken by the government to attain the goal of economic growth and tackling unemployment as SMEs are the major employees.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.