You retire from work, not life. You may have a new set of dreams for your post-retirement life. At the same time, you may also want to maintain your day-to-day lifestyle without worrying about expenses.

By planning in advance, you can define the path to achieve these life goals without any financial dependence.

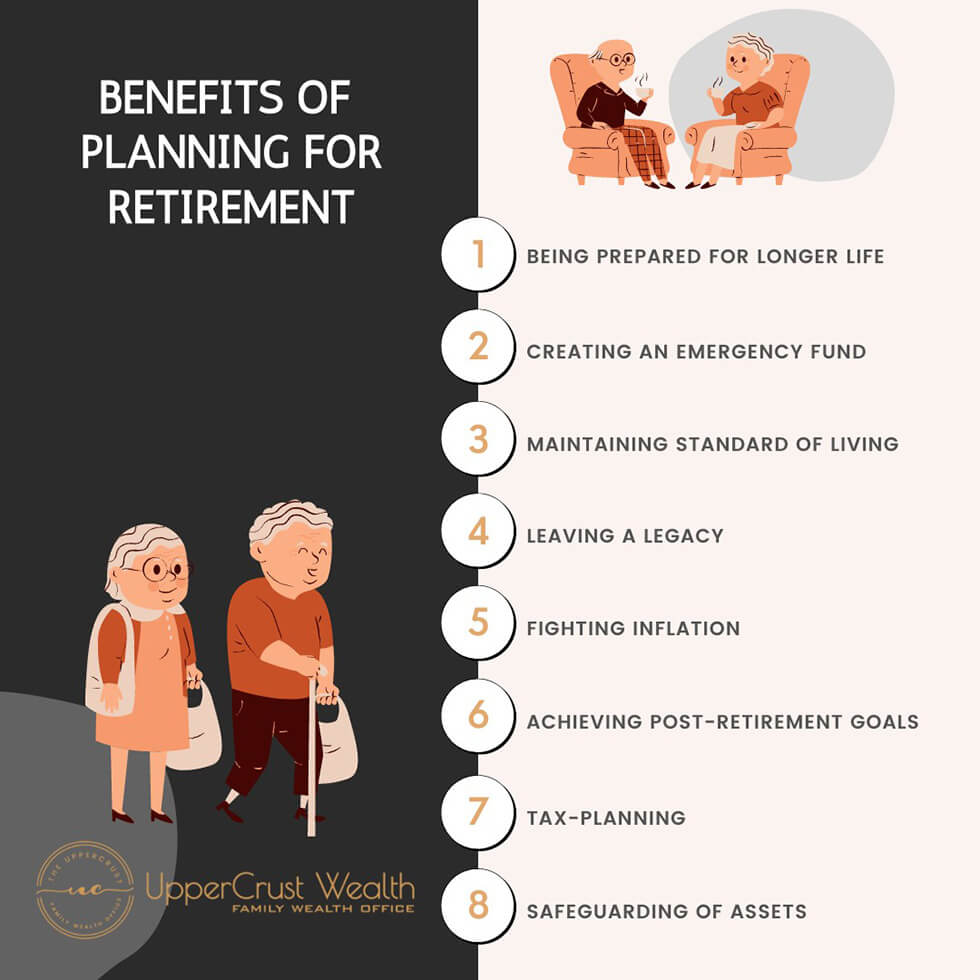

Reason for having a retirement fund:

- Prepared for longer life: As life expectancy has increased but not the retirement age hence there is much more need for having a retirement fund to support you in a long and prosperous life.

- Emergency fund: In case of a financial emergency or medical emergency, a retirement fund will support you with the right planning. A retirement corpus helps you sustain unprecedented medical emergencies.

- Maintain a standard of living: to live the same standard of life post-retirement it is necessary to have a regular income that will support your lifestyle.

- Leave a legacy: You have worked hard to provide comfort for your family. To ensure this comfort lasts for years to come even in your absence retirement fund comes into the picture.

- Fight Inflation: In India inflation (CPI) was 6.2% in 2020. This affects the standard of living. You can plan to beat inflation with a retirement fund.

- Post-retirement goals: when your work-life ends new life starts with certain goals and dreams, to achieve the same retirement planning helps.

- Tax planning: By investing your income in a feasible manner, you get tax benefits. Retirement planning options help in tax planning.

- Safeguard assets: You do not need to liquidate your assets for a better retirement income.

A retirement plan is designed to take care of your post-retirement days and help you lead a stress-free life. Ideally, the late 20s and early 30s are when one should start saving for retirement. The best time to start planning and investing for your retirement is to start today whatever maybe your current age and financial position in life.

Shaily Pandya is a Chartered Wealth Manager who is an in-house researcher. She is a founding team member at UpperCrust Wealth. She extensively supports key management for bringing their ideas into practice.