What does “Blue-chip” denote and why such companies are preferred for Investment?

Companies with high and sustainable competitive advantages that protect their market share and profitability possess high MOAT and are referred to as “Blue-chip” or “Quality” companies.

Some names with which Indian stock market associates the notion of “Quality” are Asian Paints Ltd, Nestle Limited, Britannia Ltd, Hindustan Unilever ltd, Pidilite Industries, Bajaj Finance, HDFC Bank, Titan etc.

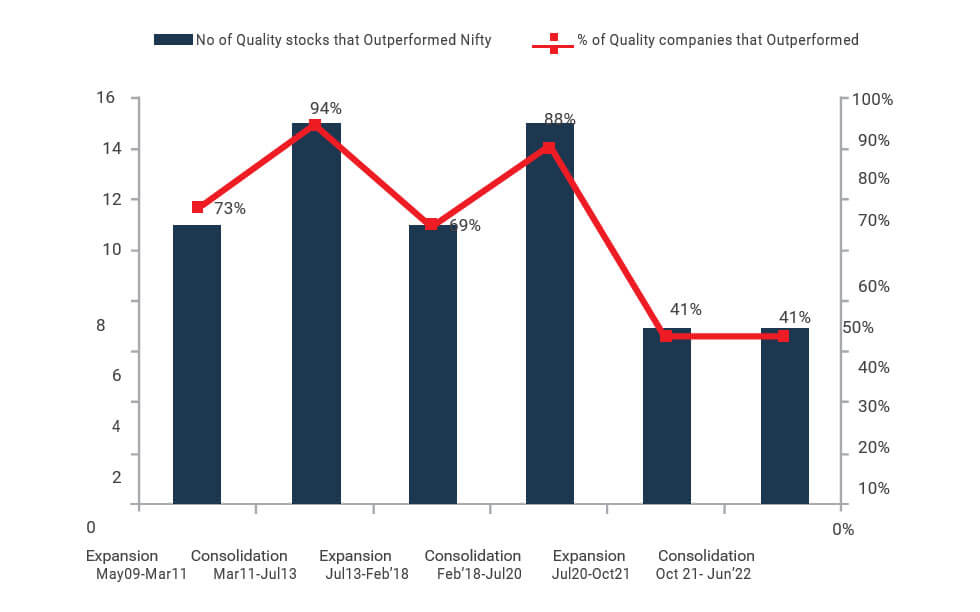

Fundamentally these companies have shown consistent Cashflow growth over the last 10-15 years. In terms of stock market performance, these “Quality companies” in times of market expansion have either yielded similar market returns or more and during consolidation these companies have fallen lesser than the market (assuming Nifty returns for illustrating market returns). In the last 10-15 years, the superior performances of these companies have been witnessed multiple times and hence the return matrix of these companies have imprinted on investors’ mind thus making them Investor favorites.

Under Performance by Quality Companies in Recent Times

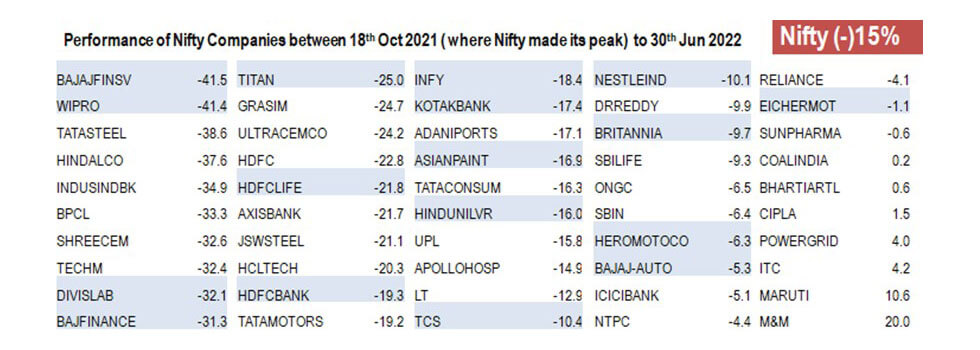

In the recent times, post Covid lows in Mar 2020, there is a strange change of behavior of these quality companies price movement vis a vis market movement. The superior performance of quality companies that seemed as a rule of the market has been overruled by the markets. In the rally from Mar 2020 lows to Oct 2021 highs, these companies delivered more or less market returns however, during the decline from Oct 2021 highs to Jun 2022 lows, these companies have fallen “more” than the market unlike what was witnessed in earlier expansion and consolidation phases of the market.

Table of Returns for Quality Nifty Companies during Oct 2021 to Jun 2022

Factors Attributed to Quality Companies Recent Underperformance

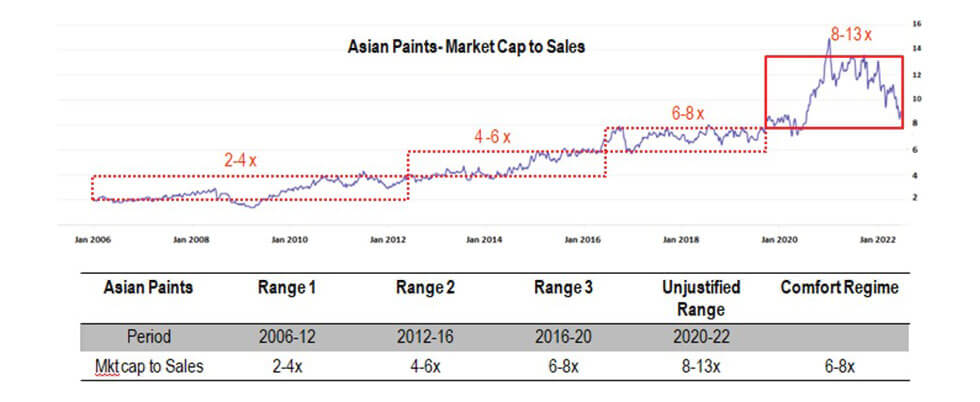

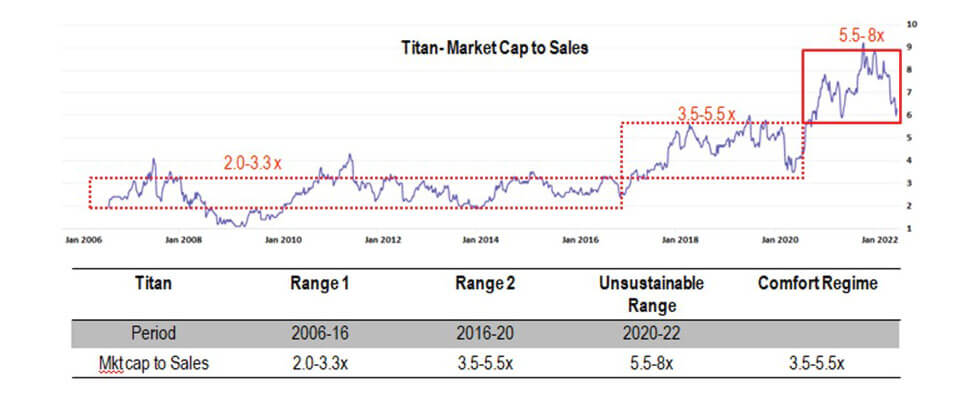

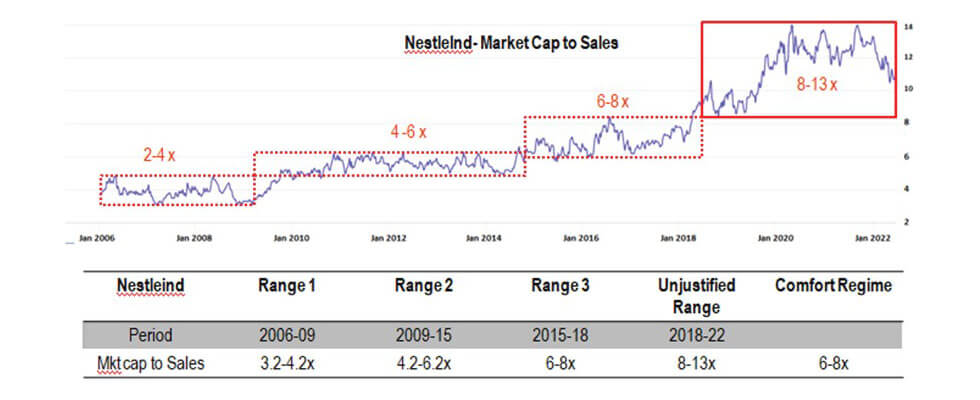

Our studies show that this inferior performance has more to do with the investment opportunity becoming wider than before in Indian context. In times of benign corporate profit growth during the last 10 years, these companies continued exhibiting consistently high cash flow growth which kept shifting their valuation range to higher and higher trajectories. Going forward, a broad based earnings growth is expected from all sectors like Banking, IT, Pharma, Industrials, Energy, Discretionary etc. This has resulted in Valuation range of the favored stocks coming down one notch lower to 2016-2020 levels.

Some Examples of Quality Companies’ Valuation Re-basing

Is Quality Out of Fashion Now?

We believe the valuation range for Quality companies are settling by the process of mean reversion. In many stocks the reset has been already done while in some the process is still continuing. Quality is here to be. There are many opportunities in good quality companies that Investors have waited for years for making an entry. This era has to be utilized for the same. We assume, companies will rebase itself to previous valuation range and then react to earnings and cash flow for the new trajectory for prices. We have seen over a long term period, companies with high cash flow and sustainable high return ratios reward stock market investors.

Hence, the faith on quality stocks is maintained and this price correction is assumed to be a part of adjustment to normalcy. In the long term, Investors make money if they are associated to good quality companies and management. So, for some time these companies may go out of fashion, but for long term investment in “Quality is Forever.”

The author is the Director – Of private Wealth at UpperCrust Wealth Pvt. Ltd. With his distinct style and belief in picking. “Return Generating Strategies” which is flexible to suit different market moods and over 25 years of experience in leading investment strategy/research team, establishing effective and well-organized investment processes, quantitative and qualitative portfolio allocation and manage client relationships in financial markets, he has worked with some of the leading names in the financial markets.