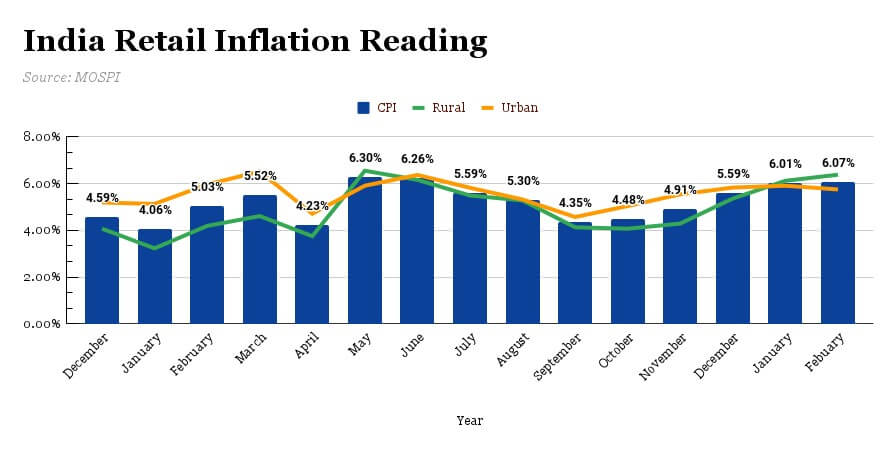

Recently Inflation has been increasing at an increased rate due to the measures which were taken by central banks to fight Economic downturned caused by Covid-19. Due to this, it has become more important for the individual to be more proactive and choose the financial strategy to keep savings intact. Currently, the Consumer Price Index in Jan 2022 has gone up to 6.01% which was only 4.06% in Jan 2021.

Let’s talk about tax which is imposed by time on all of us and how to fight these tax. I am talking about inflation. What is Inflation? Inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time.

There is a Hospitality chain in the USA called Motel 6. The name Motel 6 reflects the charge per stay at that motel chain in 1960. It started with a charge of $6 now it charges a fee of $70 per stay. So did the quality of stay at Motel 6 increase 12 fold or the facility which is provided by the motel has increased 12 times? No, it is the result of the hidden measure called inflation. Over the period of time purchasing power of $ has decreased and at the same time cost of service provided by the Motel has increased. This resulted in an increase in charge by $6 to $70 per stay.

So is Inflation good or bad?

Too much inflation is generally considered bad for an economy, while too little inflation is also considered harmful. Many economists advocate for a middle-ground of low to moderate inflation, of around 2% per year.

Generally speaking, higher inflation harms savers because it erodes the purchasing power of the money they have saved. However, it can benefit borrowers because the inflation-adjusted value of their outstanding debts shrinks over time.

So now we know how the value of money has decreased over a period of time. What are the measures by which we can fight inflation and keep the value of money intact.

Stocks are considered to be the best hedge against inflation, as the rise in stock prices is inclusive of the effects of inflation. Since additions to the money supply in virtually all modern economies occur as bank credit injections through the financial system, much of the immediate effect on prices happens in financial assets that are priced in the currency, such as stocks. Gold is also considered to be a hedge against inflation, although this doesn’t always appear to be the case looking backward.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.