We all saw what happened to the Crypto market in 2022. It got slashed by 70-80% of its value. There were numerous reasons for this like the Fall of Algo-stable coins (Terra-Luna), Small Token which was an elaborate scam, Pump and dump schemes, and other financial factors like Interest Rate hikes, Glooming recession, etc but there is a lesser-known reason which is Leverage. This was very evident in the Financial crisis of 2008 where Big institutions were negligent towards the use of Leverage. They used it like it was a brilliant shortcut to wealth creation and crashed the world’s financial markets.

So let us understand what Leverage is.

Financial leverage results from using borrowed capital as a funding source when investing to expand the firm’s asset base and generate returns on risk capital. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment.

You have 100 Rupees of investment capital and your broker gives 2x or 3x leverage which means you have 300 rupees to invest or trade with. If the investment gives you a 50 rupee return you will have an effective return of 50% and not 16.67% Seems a good deal, right? Yes, it is very good as it helps to maintain and expand businesses to grow and flourish and also gives a better return to equity investors. But if the investment goes below 200 rupees you will have to liquidate the asset and your whole investment capital would be wiped out.

Leverage has to be used very carefully. Surely it will give you tremendous growth and help you expand quickly. But at a cost and if that cost is not calculated it can be a very risky bet on the whole business. Leverage has killed more successful businesses than any other factor. Leverage is very important in the financial industry.

There are various types of leverage:

Leverage used in Business

As we discussed, business uses the Long term, and short-term debt to do various activities such as undertake new projects, increase production, create new assets, etc. Various types of debt: Debentures, Term Loans, Credit lines, etc.

It is calculated as compared to shareholders’ or owners’ capital and is known as Financial leverage whereas Operating leverage is calculated as compared to its fixed asset, turnover.

Leverage used in Personal Life

Leverage is used in personal life as well as much used in business. It is in the form of loans for cars, homes, studies, etc.

Leverage used in investing

As we discussed earlier with an example we use the leverage provided to maximize the return by investors. A few examples of leverage are Margin, Debt, etc.

Leverage used in trading

Professional traders use leverage like coffee to jack up their returns and use risk management and use the margin given to them by brokers.

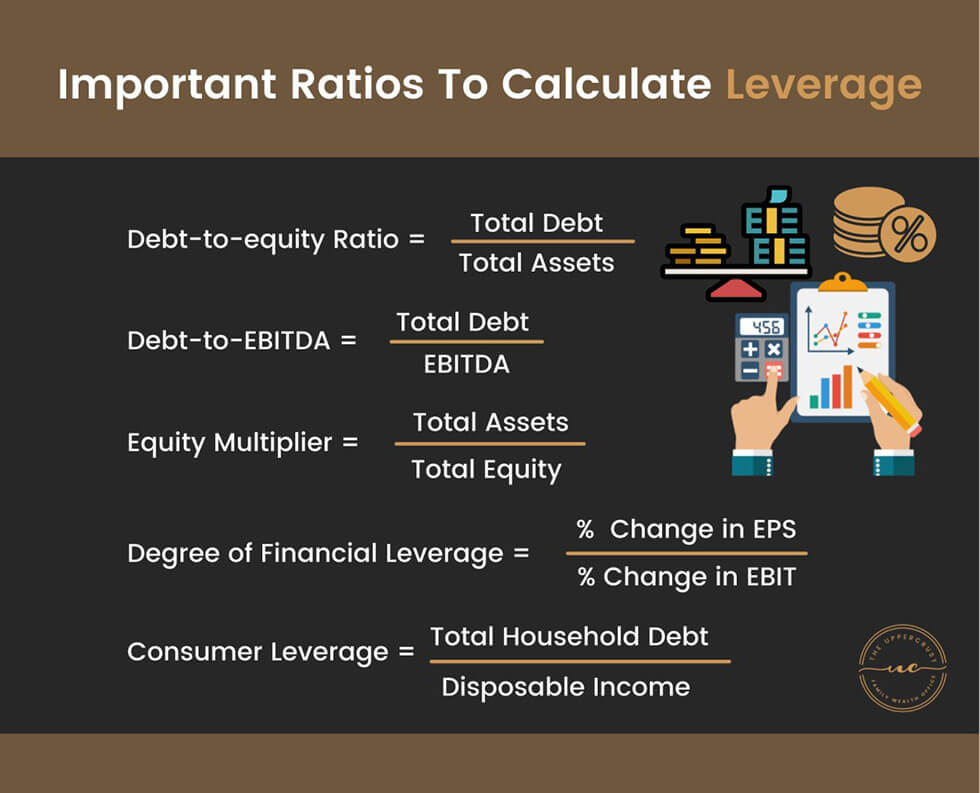

There are various ratios to calculate leverage:

- Debt-to-equity Ratio: Total Debt / Total Assets

- Debt-to-EBITDA = Total Debt / Earnings Before Interest, Taxes, Depreciation, and Amortization

- Equity Multiplier = Total Assets / Total Equity

- Degree of Financial Leverage = % Change in Earnings Per Share / % Change in Earning Before Interest and Taxes

- Consumer Leverage = Total Household Debt / Disposable Income

Few of the real-life examples of leverage-caused disasters:

- Arches Capital Management collapse was given an 8 to 1 ratio by prime lenders with which they gambled in the capital market.

- Lehman Brothers/ Merrill Lynch (Lehman’s ratio was 30.7 to 1 & Merrill Lynch’s Ratio was 26.9 to 1 at one point in time.

- Crypto exchanges gave 60 to 1, 80 to 1, 100 to 1, and some 125 to 1 leverage, this was followed by an extremely high rate of liquidation of traders all over in the recent sell-off.

Conclusion

Use this Double-edged sword wisely it will fetch what you want or might tear down whatever you have.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.