India had once been the dominant country for years in terms of Agriculture. For all those who believed India was a third world country with limited economic potential, just a few decades ago India has proved itself yet again by being the most preferred software services outsourcing and knowledge processing destination of the world. The nation has produced about 100 “unicorns” valued at over $1 billion.

2021 Global Manufacturing Risk Index: India and the US switched places–second and third–

-taking India one rank above from the rankings. India is benefiting from plant relocations from China to other parts of Asia due to its already established base in pharmaceuticals, chemicals and engineering, sectors that continue to be the focus of U.S.-China trade tensions. Recent reforms in India is key to India’s success as a global manufacturing location.

“India Emerges as 2nd Most Attractive Manufacturing Hub Globally”

– ET Bureau

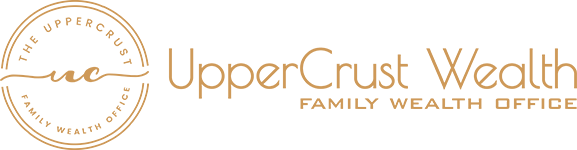

Gross Fixed Capital Formation in India increased to 13,710 INR Billion in the first quarter of 2022 from 11,520 INR Billion in the fourth quarter of 2021. There is an immediate need for revival in Capex. The Gross Fixed capital formation as a % of GDP has fallen to less than 30% currently.

India is now aiming for becoming a global manufacturing hub. In order to give manufacturing initiative a global push, Indian government tested Indian/ Global manufacturing Companies to manufacture in India by launching the Production Linked Incentive Scheme in Mar 2020.

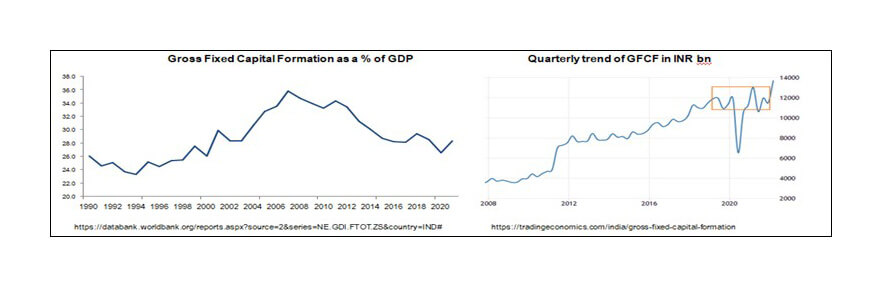

Need for PLI Framework

Macro Impacts of PLI Scheme

Government of India has announced an outlay of INR 1.97 Lac Crores for the Production Linked Incentive (PLI) Schemes across key sectors, to create national manufacturing champions. Additionally, the government is also working on reducing compliance burden, (minimum government maximum governance) improving the ease of doing business (our ranking has improved from 142 in 2014 to 63 in 2021), creating multi-modal infrastructure to reduce logistics costs, and constructing district-level export hubs.

Various Impacts of the Scheme

- Increased Production – Additional production of 500bn$ (30 lac crore+) in 5 yrs

- Reduced imports & Increased Exports – Reduce China’s imports by 50% and add yearly about Rs 2 lac crore of Exports

- Growth in GDP – Potential to add 3% to GDP annually

- Capex – More than Rs 2,00,000 Cr

- Employment – To create 60 lac new jobs

The schemes have received Interest from 900 companies and about 500 have got approvals so far for one scheme or the other. Around 20% of the companies are global multinationals while others are domestic. Nearly 50% of the domestic players are Mid and Small cap or in the MSME category. There are nearly 100 companies which are listed in stock Exchanges

What Makes PLI Scheme So Attractive For Manufacturers

1. PLI is Unique

Most countries have adopted tax reduction or tax holidays as a resort to boost production but PLI is an incentive to Sales. US, Australia, and China have launched PLI like scheme for ACC battery storage in early 2012.

2. PLI Provides a Margin Cushion to the Manufacturer

There is an inherent amount of Profitability % attached with The PLI scheme as the incentives range from 2%-20% on Incremental Sales.

3. Timely launches of PLI Scheme Extend Confidence

For most of the sectors, date timelines have been followed and there has not been much delay. Only a few have encountered delays as inputs from Industry needed to be incorporated.

4. Well Laid Down Rules for Selection of Beneficiaries

The Gazette in India notifications on guidelines for the Production Linked Incentive Scheme for any industry, lays clearly the Definitions, tenure, Eligibility, Applications Approval under the scheme and The Calculation and Disbursement of the Scheme etc. In PLI, investors are chosen for PLI based on a detailed evaluation of their proposals submitted online.

5. PLI Seeks Participation from Industry and is not an Imposition on Industry

The Government has given ample room for all types of companies- be it a global manufacturing foreign company, a local large scale domestic company, Small and Medium Scale manufacturers or even new entrants.

6. PLI will Extend to Several other Industries

About 14% of the total outlay is yet to be announced. In the near future, similar incentives are likely to be extended to several other products such as electronic segment for semiconductor FAB(s), display FAB(s), wearables, hearables, IoT devices etc.

Step by Step Inclusion of Sectors to be Benefitted by the PLI Schemes

| Budget Outlay (Rs Cr) | |

|---|---|

| March 2020 | |

| Key Starting Materials (KSMs)/Drug Intermediates (DIs) and APIs: Department of Pharmaceuticals | 6,940 |

| Large Scale Electronics Manufacturing: Ministry of Electronics and Information Technology | 40,995 |

| Manufacturing of Medical Devices: Department of Pharmaceuticals | 3,420 |

| November 2020 | |

| Electronic/Technology Products: Ministry of Electronics and Information Technology | 7,350 |

| Pharmaceuticals drugs: Department of Pharmaceuticals | 15,000 |

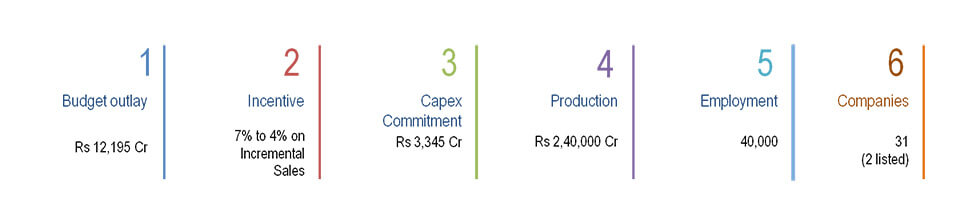

| Telecom & Networking Products: Department of Telecommunications | 12,195 |

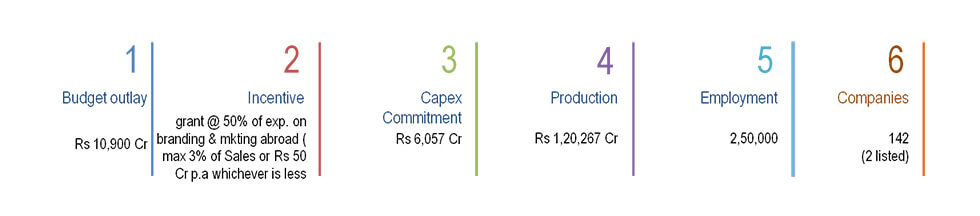

| Food Products: Ministry of Food Processing Industries | 10,900 |

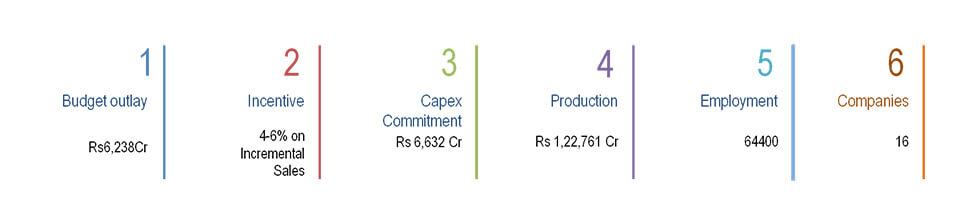

| White Goods (ACs & LED): Department for Promotion of Industry and Internal Trade | 6,238 |

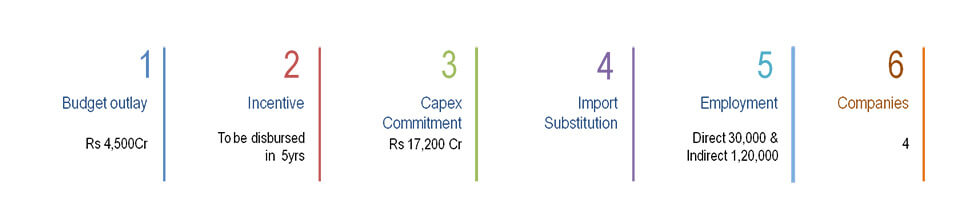

| High-Efficiency Solar PV Modules: Ministry of New and Renewable Energy | 4,500 |

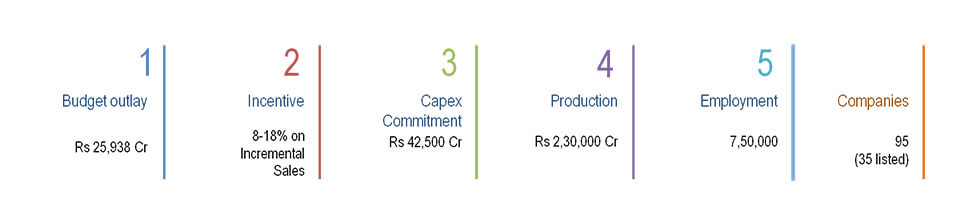

| Automobiles & Auto Components: Department of Heavy Industry | 25,938 |

| Advance Chemistry Cell (ACC) Battery: Department of Heavy Industry | 18,100 |

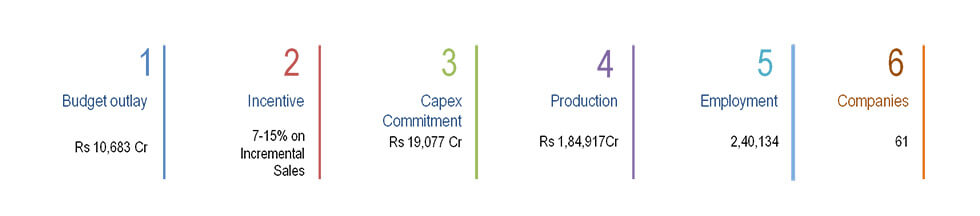

| Textile Products: MMF segment and technical textiles: Ministry of Textiles | 10,683 |

| Specialty Steel: Ministry of Steel | 6,322 |

| September 2021 | |

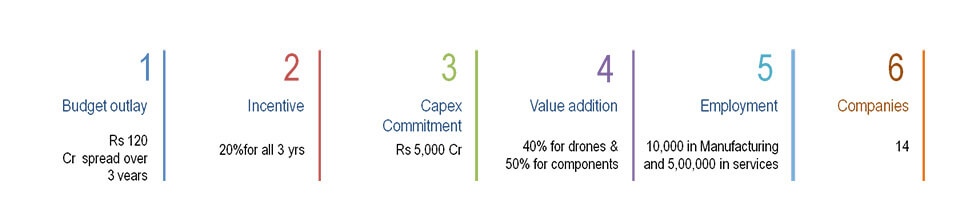

| Drones and Drone Components: Ministry of Civil Aviation | 120 |

| Total Budget Outlay out of Rs 1,97,000 Cr till date | 1,68,701 |

Detailed Sector Wise Overview

Out of 573 companies that have been approved for one scheme or the other, ~100 companies attract Stock market participants’ interest as they are listed on stock exchanges and hence available for investment freely. Maximum number of listed companies are available in Electronics, Automobiles and Auto component sector, food processing sector and Pharmaceuticals sector.

Key Starting Materials / Drug Intermediates & APIs (Phase 1)

Indian pharmaceutical industry is the 3rd largest in the world by volume and 14th largest by value. India contributes 3.5% of total drugs and medicines exported globally. However despite these achievements, India is significantly dependent on import of some basic raw materials. India imports bulk drugs to finish dosage formulations. Bulk drugs accounted for 63% of total pharmaceutical imports in the country during Fy18-19.

The Scheme has been Approved under 4 Categories

| Segment I | Fermentation based KSMs/ DIs |

| Segment II | Fermentation based niche KSMs/ DIs/ APIs |

| Segment III | Key Chemical based based KSMs/ Dis |

| Segment IV | Chemical Synthesis based niche KSMs/ DIs/ APIs |

List of Eligible Products

| S. No | Name of the KSM/DI/API |

|---|---|

| 1 | Penicillin G |

| 2 | 7-ACA |

| 3 | Erythromycin Thiocynate (TIOC) |

| 4 | Clavulanic Acid |

| 5 | Neomycin |

| 6 | Gentamycin |

| 7 | Betamethasone |

| 8 | Dexamethasone |

| 9 | Prednisolone |

| 10 | Rifampicin |

| 11 | Vitamin B1 |

| 12 | Clindamycin Base |

| 13 | Streptomycin |

| 14 | Tetracycline |

| 15 | Ritonavir |

| 16 | Lopinavir |

| 17 | Acyclovir |

| 18 | Carbamazepine |

| 19 | Oxcarbazepine |

| 20 | Vitamin B6 |

| 21 | Levodopa |

| 22 | 1.1 Cyclohexane Diacetic Acid (CDA) |

| 23 | 2-Methyl-5Nitro- Imidazole (2-MNI) |

| 24 | Dicyandiamide (DCDA) |

| 25 | Para Amino Phenol |

| 26 | Meropenem |

| 27 | Atorvastatin |

| 28 | Olmesartan |

| 29 | Valsartan |

| 30 | Losartan |

| 31 | Levofloxacin |

| 32 | Sulfadiazine |

| 33 | Ciprofloxacine |

| 34 | Olfloxacin |

| 35 | Narfloxacine |

| 36 | Artesunate |

| 37 | Telmisartan |

| 38 | Aspirin |

| 39 | Diclofenac Sodium |

| 40 | Levetiracetam |

| 41 | Carbidopa |

Note: The 41 eligible products for which the Scheme is proposed covers the 53 APIs Whichhave been approved by the Government.

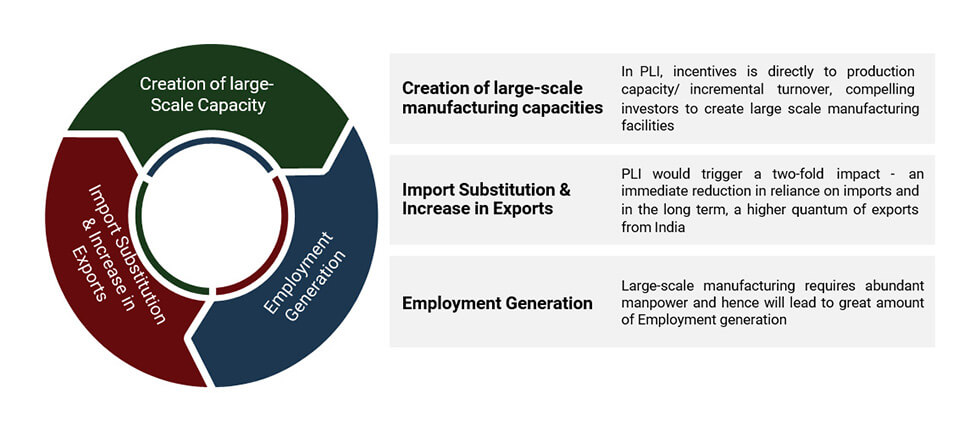

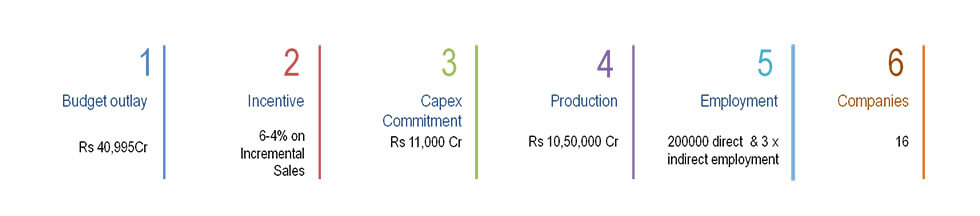

Large Scale Electronics Manufacturing

Electronics manufacturing: The budget outlay for this scheme is INR 400 billion (US$5.38 billion). The scheme offers a production linked incentive to boost domestic manufacturing and attract large investments in mobile phone manufacturing and specified electronic components, including Assembly, Testing, Marking and Packaging (ATMP) units. The Scheme would tremendously boost the electronics manufacturing landscape and establish India at the global level in electronics sector.

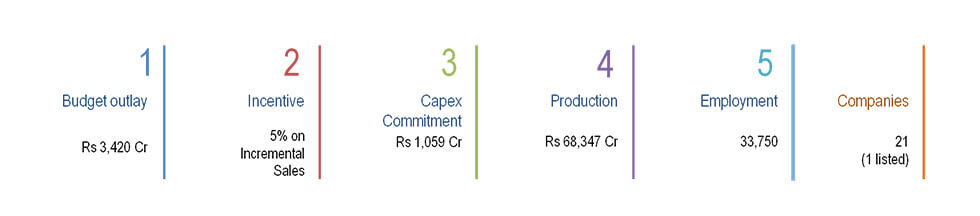

Manufacturing of Medical Devices

Medical Device is a growing sector and its potential for growth is the highest among all sectors in the healthcare market. It is valued at Rs. 50,026 crore for 2018-19 and is expected to reach to Rs. 86,840 crore by 2021-22. India depends on imports up to an extent of 85% of total domestic demand of medical devices. The Medical Device sector suffers from a cost of manufacturing disability of around 12% to 15%, vis-a-vis competing economies, among other things, on account of lack of adequate infrastructure, domestic supply chain and logistics, high cost of finance, inadequate availability of quality power, limited design capabilities and low focus on R&D and skill development, etc. There is, thus, a need for a mechanism to compensate for the manufacturing disability.

The target for PLI Scheme is to provide assistance to about 25-30 manufacturers under the following categories of medical devices:- Cancer care / Radiotherapy medical devices, Radiology & Imaging medical devices (both ionizing & non-ionizing radiation products) and Nuclear Imaging Devices, Anesthetics & Cardio-Respiratory devices incl. Catheters of Cardio Respiratory Category & Renal Care Medical Devices and AII Implants including implantable electronic devices like Cochlear Implants and Pacemakers.

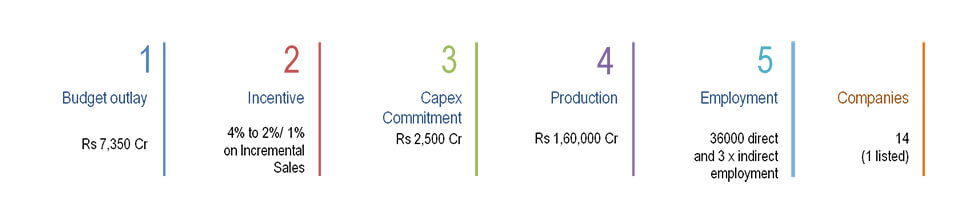

Electronic/Technology Products

The target segments under the PLI Scheme for IT Hardware include Laptops, Tablets, All-in- One Personal Computers (PCs) and Servers. Currently, the laptop and tablet demand in India is largely met through imports valued at USD 4.21 billion and USD 0.41 billion respectively in 2019-20. The market for IT Hardware is dominated by 6- 7 companies globally which account for about 70% of the world’s market share. These companies are able to exploit large economies of scale to compete in global markets. It is imperative that these companies expand their operations in India and make it a major destination for manufacturing of IT Hardware. Domestic Value Addition is expected to grow from the current 10-15 percent to 25-30 percent.

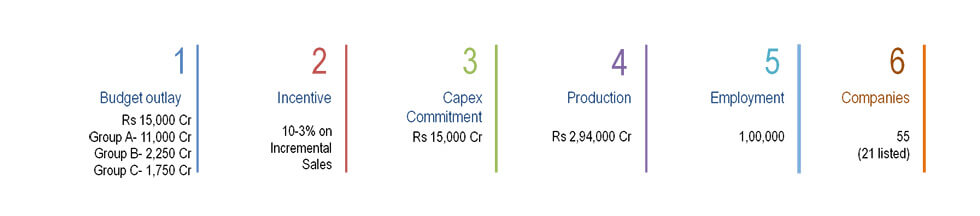

Key Starting Materials /Drug Intermediates & APIs (Phase 2)

The PLI Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs) / Drug Intermediates (DIs) / Active Pharmaceutical Ingredients (APIs) in India or PLI Scheme for Promoting Domestic Manufacturing of Medical Devices

Group A – Applicants having Global Manufacturing Revenue (FY 2019-20) of pharmaceutical goods and/or in vitro Diagnostic Medical Devices more than or equal to Rs. 5,000 crore

Group B – Applicants having Global Manufacturing Revenue (FY 2019-20) of pharmaceutical goods and/or in vitro Diagnostic Medical Devices between Rs. 500 (inclusive) crore and Rs. 5,000 crore

Group C – Applicants having Global Manufacturing Revenue (FY 2019-20) of pharmaceutical goods and/or in vitro Diagnostic Medical Devices less than Rs. 500 crore. This group shall include a sub-group for MSME applicants, i.e., applicants registered as Micro, Small & Medium Enterprises (MSME) with the Ministry of MSME, Government of India.

Telecom and Networking Products

India is the second-largest telecommunications market in the world (after China) in terms of subscribers and internet users. As per the Telecom Regulatory Authority of India (TRAI) data, subscriber base in the country stood at ~1.2 billion (as of August 2021), while internet users stood at ~825.30 million (as of March 2021). The PLI scheme, which aims to make India a telecom equipment manufacturing hub by attracting global investments as well as nurture homegrown companies.

The scheme’s target segment includes Core transmission equipment, 4G/5G next-generation radio access network and wireless equipment, Access and customer premises equipment (CPE), Internet of Things (IoT) access devices and Other wireless equipment and enterprise equipment (for example: switches, routers, etc.).

Food Products

The implementation of the scheme would facilitate expansion of processing capacity to generate processed food output of Rs 33,494 crore and create employment for nearly 2.5 lakh persons by the year 2026-27.

The scheme is made up of the following components:

- Incentivize the manufacture of four major food product segments: ready-to-cook/ready- to-eat foods, marine products, processed fruits and vegetables, and mozzarella cheese. Innovative and organic products from small and medium-sized enterprises (SMEs), such as eggs, egg products, and poultry meat, are covered under this component.

- Support the branding and marketing of select Indian food products abroad to enable their entry into international food markets and increase their visibility.

Details of Each Category

| Category | Details |

|---|---|

| Category I | Applicants are large entities who apply for Incentive based on Sales and Investment Criteria. Applicants could undertake Branding & Marketing activities abroad also and apply for grant under the scheme with a common Application. |

| Category II | SMEs Applicants manufacturing innovative/ organic products who apply for PLI Incentive based on Sales. |

| Category III | Applicants applying solely for grant for undertaking Branding & Marketing activities abroad. |

White Goods (ACs & LED) Tranche 1 and Tranche 2

The PLI Scheme for White Goods (PLIWG) was notified in April 2021, to provide financial incentives to boost domestic manufacturing and attract large investments in the white goods manufacturing value chain.

The target segments under air conditioners are:

- Air conditioners (components-high value intermediates or low value intermediates or sub- assemblies or a combination thereof).

- High value intermediates (copper tubes, aluminum foil, and compressors).

- Low value intermediates (PCB assembly for controllers, BLDC motors, service valves, and cross flow fans for AC and other component.

- The target segments under LED include:

- LED lighting products (core components like LED chip packaging, registers, ICs, fuses, and large-scale investments in other components).

- Components of LED lighting products (like LED chips, LED drivers, LED engines, mechanicals, packaging, modules, wire wound inductors, and other components).

- 19 applications received in the second round under the PLI Scheme for White Goods and Four applicants are being referred to the Committee of Experts (CoE) for examination and its recommendations.

High-Efficiency Solar PV Modules (Tranche1 closed, Tranche 2 open)

There is an ambitious target set by the Government of India to achieve 500 Giga Watts of Energy from renewable energy resources in order to meet half of the country’s energy needs by the end of 2030. The government wants to achieve this target with solar and wind energy contributing 400 GW and the rest is to be met my Hydro and other renewable resources.

The PLI scheme is in furtherance to this target. The minimum capacity of the manufacturing unit to be installed shall be 1,000 Megawatt. Apart from other benefits there will be Additional 10,000 MW capacity of integrated solar PV manufacturing plants, Direct investment of around Rs.17,200 crore in solar PV manufacturing projects, Demand of Rs.17,500 crore over 5 years for ‘Balance of Materials‘ and Impetus to Research & Development to achieve higher efficiency in solar PV modules.

Tranche II has been proposed by the government with the increase in allocation to Rs 24,000 crore.

Auto & Auto Components

The scheme is expected to boost domestic manufacturing capacity, including the production of electric and hydrogen fuel cell vehicles. The PLI scheme seeks to benefit makers of advanced automotive technologies or auto components – whose domestic supply chains are weak, dormant, or non-existent. The scheme excludes conventional petrol, diesel, and CNG segments (internal combustion engine) since these have sufficient production capacity in India. The PLI scheme for the automobile sector has two parts.

The Champion OEM Incentive Scheme is for battery electric vehicles and hydrogen fuel cell vehicles of all segments.

The Component Champion Incentive Scheme is for advanced automotive technology components of all vehicles, CKD/SKD kits, vehicle aggregates of 2-wheelers, 3-wheelers, passenger vehicles, commercial vehicles, and tractors.

Advanced Chemical Cell (ACC) Batteries

An outlay of INR 181 billion (US$2.43 billion) has been earmarked by the government towards the scheme, which is intended to establish local manufacturing capacity of 50 Giga Watt Hour (GWh) of ACC and five GWh of Niche ACC capacity.

This scheme is in sync with India’s objective of accelerating EV adoption over the coming decade, while also reducing the dependence on imports. The manufacturing facility as proposed by the beneficiary firm would have to be commissioned within a period of 2 years. The subsidy will be disbursed thereafter over a period of 5 years. ACC PLI scheme is expected to accelerate EV adoption and hence translate into net savings of Rs 2,00,000 crore to Rs 2,50,000 crore on account of oil import bill during the period of this program and increase the share of renewable energy at the national grid level.

Textile Products: MMF Segment and Technical Textiles

Government approved PLI Scheme for Textiles products namely MMF Apparel, MMF Fabrics and Products of Technical Textiles for enhancing India’s manufacturing capabilities and enhancing exports. The scheme has two parts, Part 1 where minimum investment is Rs. 300 crore and minimum turnover required to be achieved for incentive is Rs.600 crore; and Part-2, where minimum investment is of Rs. 100 crore and minimum turnover required to be achieved for incentive is Rs. 200 crore. The government is eyeing the second edition of production-linked incentive (PLI) scheme for textiles and has begun consultations with the industry.

Drones and Drone Components

India has the potential of becoming a global drone hub by 2030 , given its traditional strengths in innovation, information technology, frugal engineering and its huge domestic demand. The drones and drone components manufacturing industry may see an investment of over INR 5,000 crore over the next three years. The annual sales turnover of the drone manufacturing industry may grow from INR 60 crore in 2020-21 fold to over INR 900 crore in FY 2023-24. The drone services industry (operations, logistics, data processing, traffic management etc.) is far bigger in scale. It is expected to grow to over INR 30,000 crore in next three years.

Specialty Steel

In 2019-20, India was the 2nd largest producer of steel in the world. The country is also the 2nd largest consumer of finished steel as per the World Steel Association. Capacity for domestic crude steel production expanded from 109.85 MTPA in 2014-15 to 142.24 MTPA in 2018-19. India exported USD 5,182 Mn worth of steel in 2019-20 and imported USD 6,304 Mn worth of steel in the same FY. In 2020-21, India’s steel exports were at USD 6,356 Mn and imports were at USD 4,333 Mn. Going forward, the domestic steel consumption would need to increase significantly to ~160 MTPA by 2024-25. Current planned capacity expansions of existing players are expected to add approximately 28-30 MTPA by 2024-25. To meet the increased demand, an additional capacity of 25-30 MTPA would be required. The growth potential for the sector is thus immense and the domestic steel consumption will increase significantly in line with this vision.

The five categories of specialty steel that have been selected in the PLI scheme are coated/ plated steel products, high strength/wear resistant steel, specialty rails, alloy steel products and steel wires, and electrical steel.

Guidelines were released in November 2021 and the ministry has opened the window for applications. Due to tepid response, the steel ministry has made many changes in the actual format of the scheme after consultation with big steel companies. The last date for application was extended to 31st July 2022.

Listed Companies Approved for PLI Scheme

| Listed Companies | Sector |

|---|---|

| Rajesh Exports Limited | Advanced chemical cell (ACC) batteries |

| Alicon Castalloy Ltd | Auto and Auto Components |

| Asahi India Glass Ltd. | Auto and Auto Components |

| Ashok Leyland Ltd | Auto and Auto Components |

| Automotive Axles Ltd | Auto and Auto Components |

| Bajaj Auto Ltd | Auto and Auto Components |

| Bharat Forge Ltd | Auto and Auto Components |

| Bharat Heavy Electricals Ltd | Auto and Auto Components |

| Bosch Ltd | Auto and Auto Components |

| Ceat Ltd | Auto and Auto Components |

| Hero MotoCorp Ltd. | Auto and Auto Components |

| Lumax Auto Technologies Ltd | Auto and Auto Components |

| Mahindra & Mahindra Ltd. | Auto and Auto Components |

| Maruti Suzuki India Ltd | Auto and Auto Components |

| Minda Corporation Ltd | Auto and Auto Components |

| Minda Industries Ltd | Auto and Auto Components |

| Motherson Sumi Systems Ltd | Auto and Auto Components |

| Motherson Sumi Wiring India Ltd | Auto and Auto Components |

| Pricol Ltd | Auto and Auto Components |

| Sandhar Technologies Ltd | Auto and Auto Components |

| Sansera Engineering Ltd | Auto and Auto Components |

| Schaeffler India Ltd | Auto and Auto Components |

| Sharda Motor Industries Ltd | Auto and Auto Components |

| Sona BLW Precision Forgings Ltd | Auto and Auto Components |

| Steel Strips Wheels Ltd | Auto and Auto Components |

| Sundram Fasteners Ltd | Auto and Auto Components |

| Tata Motors Ltd | Auto and Auto Components |

| The Hi-Tech Gears Ltd | Auto and Auto Components |

| Tube Investments Of India Ltd | Auto and Auto Components |

| TVS Motor Company Ltd | Auto and Auto Components |

| Varroc Engineering Ltd | Auto and Auto Components |

| Wabco India Ltd | Auto and Auto Components |

| Dixon Technologies (India) Limited | Electronics and IT hardware |

| Britannia Industries Ltd | Food Processing |

| Dabur India Limited | Food Processing |

| Foods and Inns Ltd | Food Processing |

| Hatsun Agro Product Ltd | Food Processing |

| Hindustan Unilever Limited | Food Processing |

| ITC Limited | Food Processing |

| KRBL Ltd | Food Processing |

| LT Foods Limited | Food Processing |

| Marico Ltd | Food Processing |

| Nestle India Ltd | Food Processing |

| Parag Milk Foods Limited | Food Processing |

| Prataap Snacks Limited | Food Processing |

| Tasty Bite Eatables Limited | Food Processing |

| Tata Consumer Products Limited | Food Processing |

| Vadilal industries Ltd | Food Processing |

| Varun Beverages Ltd | Food Processing |

| Zydus Wellness Limited | Food Processing |

| Poly Medicure Ltd | Medical Devices |

| Aarti Specialty Chemicals Limited | Pharmaceuticals Phase 1 |

| Sadhna Nitro Chem Limited | Pharmaceuticals Phase 1 |

| Surya Life Sciences Ltd | Pharmaceuticals Phase 1 |

| Aarti Industries | Pharmaceuticals Phase 2 |

| Alembic Pharmaceuticals Ltd | Pharmaceuticals Phase 2 |

| Aurobindo Pharma Ltd | Pharmaceuticals Phase 2 |

| Bal Pharma | Pharmaceuticals Phase 2 |

| Biocon Ltd | Pharmaceuticals Phase 2 |

| Cadila Healthcare | Pharmaceuticals Phase 2 |

| Cipla Ltd | Pharmaceuticals Phase 2 |

| Dr Reddy’s Lab | Pharmaceuticals Phase 2 |

| Glenmark Pharmaceuticals | Pharmaceuticals Phase 2 |

| Lupin Ltd | Pharmaceuticals Phase 2 |

| Natco Pharma | Pharmaceuticals Phase 2 |

| Neogen Chemicals Ltd | Pharmaceuticals Phase 2 |

| Panacea Biotec | Pharmaceuticals Phase 2 |

| Strides Pharma Science Ltd | Pharmaceuticals Phase 2 |

| Sun Pharmaceuticals Industries Limited | Pharmaceuticals Phase 2 |

| Torrent Pharmaceuticals | Pharmaceuticals Phase 2 |

| Venus Remedies | Pharmaceuticals Phase 2 |

| ITI Limited | Telecom & Networking Products |

| Tejas networks Limited | Telecom & Networking Products |

| Arvind Limited | Textiles & Apparels- Edition 1 |

| AYM Syntex Limited | Textiles & Apparels- Edition 1 |

| Donear Industries Ltd. | Textiles & Apparels- Edition 1 |

| Ginni Filaments Limited | Textiles & Apparels- Edition 1 |

| Gokaldas Exports Limited | Textiles & Apparels- Edition 1 |

| Himatsingka Seide Limited | Textiles & Apparels- Edition 1 |

| K G Denim Limited | Textiles & Apparels- Edition 1 |

| Monte Carlo Fashions Limited | Textiles & Apparels- Edition 1 |

| Pearl Global Industries Limited | Textiles & Apparels- Edition 1 |

| Sangam (India) Limited | Textiles & Apparels- Edition 1 |

| SVP Global Textiles Limited | Textiles & Apparels- Edition 1 |

| Trident Limited | Textiles & Apparels- Edition 1 |

| Amber Enterprises India Limited | White Goods- Tranche 1 |

| Calcom Vision Ltd | White Goods- Tranche 1 |

| Cosmo Flims Limited | White Goods- Tranche 1 |

| Havells India Limited | White Goods- Tranche 1 |

| Hindalco Industries Ltd | White Goods- Tranche 1 |

| IFB Industries Limited | White Goods- Tranche 1 |

| Johnson Controls Hitachi Air Conditioning India Ltd | White Goods- Tranche 1 |

| Orient Electric Limited | White Goods- Tranche 1 |

| PG Technoplast Private Limited | White Goods- Tranche 1 |

| Stovekraft Limited | White Goods- Tranche 1 |

| Surya Roshni Limited | White Goods- Tranche 1 |

| Voltas Ltd | White Goods- Tranche 1 |

| Crompton Greaves Electrical limited | White Goods- Tranche 2 |

| Jindal polyfilms Limited | White Goods- Tranche 2 |