Investing in startup companies is a very risky business, but it can be very rewarding if and when the investments do pay off.

Why invest in start-ups?

1. Early investment

Startup investing gives investors an opportunity to come in early and reap the reward of being patient and investing in early stages. Investing in early stages of a startup gives an immense growth potential in various industries.

2. Diversification

There are a lot of industries in which start-up investing is done and a lot of them are future-based and various options let the investor diversify their portfolio sector-wise as well as the type of investments.

3. High Risk and Reward

Investing in a start-up that has not proved viability or achieved profitability involves high risk, with this high-risk results in high return. The type of return that not any other asset class can generate.

4. Impact investing

Investing in start-ups is directly contributing toward innovation in which socially conscious investors want to have crucial changes like ESG, climate change reversal, food scarcity, etc. This opportunity is available while investing in start-ups as they have an influence on start-ups.

5. Buy-outs

Start-ups investing are not just preferred by individuals, they are seen as very attractive investments by corporations for various reasons. This gives an exit opportunity for investors who have invested in the start-ups when product development stages or early stages.

How to invest in startups?

How to identify and evaluate a startup worth investing in? There is no exact science behind how to evaluate the startup but there are techniques through which successful angel investors have made their best investment in any start-up. One of these techniques is the T5 model:

- Total Addressable Market

- Team

- Traction

- Timing

- Technology

1. Total addressable market

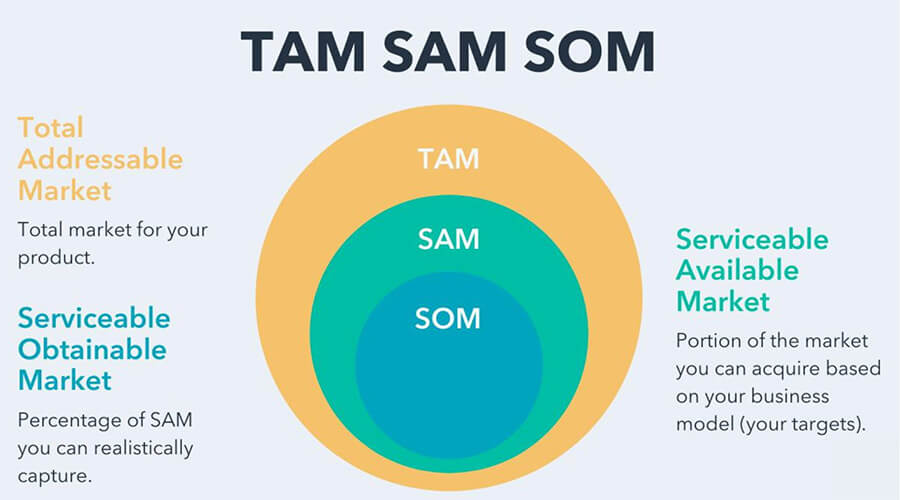

TAM refers to the total market demand for a product or service. It’s the maximum amount of revenue a business can possibly generate by selling its product or service in a specific market.

TAM is a metric that is a key component of a business plan, particularly for a startup to craft its marketing and sales strategy, set realistic revenue goals, and choose to enter the markets that are worth their time and resources. When we are assessing a startup its first essential is to know and measure the TAM and our of that how much they can service in current growth and how much they aim to with the current state. It is calculated by bottom-up analysis of the business.

Numbers of customers in the market X Average annual revenue of the customer

This is used to measure the exact market value that a startup is aiming to do business in a given period of time for a given situation. Due to limitations(Geographical, etc) now the whole TAM can be addressed by the startup and it is carved out to SAM(Serviceable Addressable Market) and which is in turn carved into SOM(Serviceable Obtainable Market) which is the value of the customer they can convince to buy the given product or service.

2. Team

If a business is a human body then a team of the business is the organs of the body. There is a huge amount of focus on the business team for the success of any start-up. The way they function individually and together determines how business development takes place. To evaluate a team there are a few parameters that are very important to look at. These are as follows :

- Hunger for win

- Business acumen

- Intelligence

- Perseverance

All the four given parameters are interlinked with all the factors of the T5 model.

3. Traction

Business traction is the initial progress and momentum a startup builds as it grows. Traction indicates that the products and services your business is offering are viable.

It is the stage where the startup takes off. It helps us to understand where business is headed and how we navigate to reach the destination. It also shows that what you’re providing has achieved market fit, and the brand is growing, for you are attracting attention from the right audience. It is also to understand how visible the product or service is and what demographics they are serving and aims to serve. Profitability is not a single metric of traction. There are various metrics such as monthly signups, clicks, churn rate, etc. these can be widely segregated into the following metrics:

- Revenues

- Profitability

- Clients and Partnerships

- Active Users

- Stakeholders’ Engagement

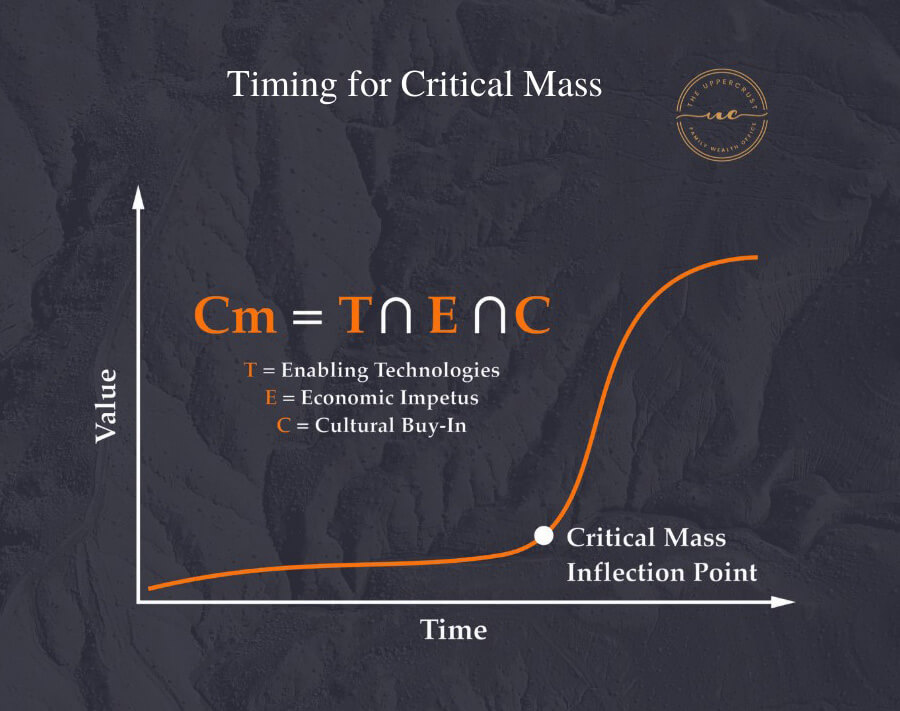

4. Timing

Market timing is a critical element in the growth and success of any business. Timing can be defined as launching the product or service at the right time in the right place. If your startup arrives too early, you may not get the expected traction. If it enters the market late, there are already competitors and entry barriers to fend off, and your startup may end up being a case of ‘me-too’.So, let’s assume that your idea is fantastic, you have a strong team in place and even there is sufficient funding at your disposal to scale it. However, if the market is not ready to buy your product, nothing else matters or works. There are preconditions to get the correct timing of the business:

- Enabling technology

- Economic Impetus

- Cultural Buy-in

5. Technology

Now, this is a time when all the new businesses will be Technology-based startups or Technology-enabled startups. There is no other type of startup which are going to succeed.

Technology-based startup: Also known as a tech company, it is a firm focusing on the development and manufacturing that uses leading-edge scientific and technological knowledge systematically and continuously to produce new goods or services with high added value.

tech-enabled startups use existing technology to improve the efficiency or performance of a product the market already uses. Tech-enabled companies aren’t building the internet, mobile devices, or social media platforms; they’re using those technologies. To understand the startup it is very crucial to understand the product and service that the business is offering and which type of tech they are relying on: making a tech or using a tech.

Before you invest

First-time investors need to understand the pros and cons of investing in start-ups very carefully and assess the start-ups accordingly. It takes time to evaluate on their own. New startup investors can join investor groups like angel investor groups or platforms which provide an opportunity to invest in start-ups that are SEBI registered and over the period of time investors can start using experience and metrics to evaluate start-ups.

Sachin Shah is a guest writer who is an independent researcher and educational blogger.